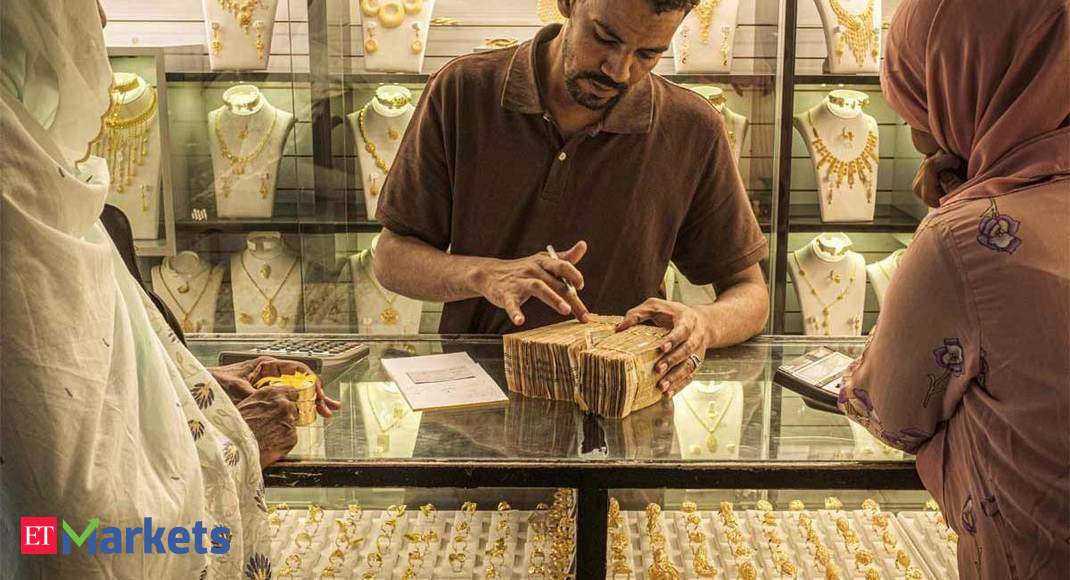

BENGALURU/MUMBAI: Healthy sales during a recent festival encouraged Indian jewellers to continue stocking up this week, while more supply started to make its way into Singapore and Hong Kong as dealers navigate around COVID-19-led bottlenecks.

Indians celebrated the Dussehra festival on Sunday, and now await Diwali and Dhanteras in November.

“Dussehra sales gave confidence to jewellers. They’re now buying for Diwali,” said a Mumbai-based dealer with a bullion importing bank.

Premiums of $1 an ounce were charged over official domestic prices, including 12.5% import and 3% sales levies, from $5 premiums last week. Local gold futures were trading around 50,500 rupees ($682.96) per 10 grams.

“Retail consumers are slowly adjusting to higher prices,” said Aditya Pethe, director at Waman Hari Pethe Jewellers.

In Singapore, premiums of $0.80-$1.30 an ounce were charged over international spot prices.

“As more countries adjust to the ‘new normal’, we see less logistical constraints as more refineries and mints are back to operations (though with limited man power),” said Zvika Rotbart, South East Asia business development executive at J. Rotbart & Co.

But shipping costs are still higher since commercial flights are not back to usual, Rotbart added.

Demand in Singapore was subdued, despite a decline in global prices.

“A lot of jewellery demand comes from overseas, particularly clients from Dubai, India and China. Now because of travel restrictions, not many are allowed to be in Singapore,” and that could hit Diwali demand, said Brian Lan, managing director at dealer GoldSilver Central.

Dealers in China offered discounts of $30-$32 an ounce versus $30-$33.5 last week.

Chinese discounts would narrow in the fourth quarter as demand gradually improves, a World Gold Council official said.

In Hong Kong, gold was sold between a $0.50 discount and a $1.50 premium.

Fewer supply disruptions and weak demand over the past month have led to increased supply, said Keanan Brackenridge, product manager at LPM Group Ltd.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending