Sterling softens broadly today as UK unemployment rate rose more than expected while the part of the country is returning to restrictions. Additionally, there appears to be no progress on Brexit negotiation ahead of the EU summit later this week. Australian Dollar is the second weakest as China moves to stop importing the country’s coal. New Zealand Dollar is currently the strongest, mainly thanks to cross buying against Aussie. Meanwhile, Canadian Dollar and US Dollar are the next strongest. Focus will turn to development in the US stock markets, as the attempt to break into new record high is hampered by J&J’s pause of its coronavirus vaccine studies.

Technically, there isn’t any breakthrough in the forex markets so far. Dollar and Yen are both still in near term decline respite this week’s recovery. Levels to watch include 1.1732 support in EUR/USD, 1.2845 support in GBP/USD, 0.7095 support in AUD/USD, 0.9797 resistance in USD/CHF, 1.3242 resistance in USD/CAD, 104.94 support in USD/JPY, 123.84 support in EUR/JPY, and 135.87 support in GBP/JPY.

In Europe, currently, FTSE is down -0.26%. DAX is down -0.80%. CAC is down -0.48%. Germany 10-year yield is down -0.0017 at -0.544. Earlier in Asia, Nikkei rose 0.18%. Japan 10-year JGB yield dropped -0.0016 to 0.031. China Shanghai SSE rose 0.04%. Singapore Strait Times rose 0.60%.

– advertisement –

US CPI ticked up to 1.4% yoy in Sep, core CPI unchanged at 1.7% yoy

US CPI rose 0.2% mom in September, matched expectation. Core CPI rose 0.2%, also matched expectations. Annually, headline CPI accelerated to 1.4% yoy, up from 1.3% yoy, matched expectations. CPI core was unchanged at 1.7% yoy, matched expectations.

Germany ZEW dropped sharply to 56.1, great euphoria evaporated

Germany ZEW Economic Sentiment dropped sharply to 56.1 in October, down from 77.4, missed expectation of 74.0. Germany Current Situation Index improved to -59.5, up from -66.0, slightly better than expectation of -60. Eurozone ZEW Economist Sentiment dropped to 52.3, down from 7.39, well below expectation of 70.5. Eurozone Current Situation rose 4.3 pts to -76.6.

“The ZEW Indicator of Economic Sentiment is still very clearly in positive territory. However, the great euphoria witnessed in August and September seems to have evaporated. The recent sharp rise in the number of COVID-19 cases has increased uncertainty about future economic development, as has the prospect of the UK leaving the EU without a trade deal. The current situation in the run-up to the presidential election in the United States further fuels uncertainty,” comments ZEW President Achim Wambach.

CPI was finalized at -0.2% mom, -0.2% yoy in September.

ECB Knot: Second wave pandemic will have a less dramatic impact

ECB Governing Council member Klaas Knot said the second wave of coronavirus pandemic “will have a less dramatic impact than the first, for which we were totally unprepared”.

“We know a bit more about the virus now, and businesses have learned to adapt where possible, for instance through online retail,” he added. “Early indicators point at slowing growth. It is clear the second wave will dent the recovery, but it is too early to say by how much.”

Regarding ECB’s measures, Knot said, “the costs of ending measures too soon are higher than the costs of maintaining them longer than necessary. And we must avoid ending them all at once. When the time comes, the exit must be gradual and predictable.”

UK unemployment rate rose to 4.5% in Aug, claimant counts added 2.7m in Sep

UK unemployment rose to 4.5% in the three months to August, up from 4.3%, above expectation of 4.3% too. That;s also 0.6% higher than a year ago. Though, total actually weekly hours worked rebounded with a record increase of 20.0m over the quarter, or 2.3%, to 891m hours. Average weekly hours worked rose 0.7 hours to 27.3 hours. Average earnings including bonus rose 0.0% 3m/y in August. Average earnings excluding bonus rose 0.8% 3omy.

Claimant counts rose 2.7m in September represents a monthly increase of 1.0%. That’s 120.3% higher than the figure in March.

China’s imports and exports surged in Sep, trade surplus shrank

In September, in USD terms, China’s total trade rose 11.4% yoy to USD 442.5B. exports rose 9.9% yoy to USD 239.8B. Imports rose 13.2% yoy to USD 202.8B Trade surplus came in at USD 37.0B, down from August’s USD 58.9B and missed expectation of USD 59.3B.

Year-to-date, total trade dropped -1.8% yoy to USD 3298B. Imports dropped -0.8% yoy to USD 1811B. Exports dropped -3.1% yoy to USD 1485B. Trade surplus was at USD 326B.

With the EU, year-to-date, total trade rose 0.4% yoy to USD 461.2B. Exports rose 3.1% yoy to USD 279.5B. Imports dropped -3.6% yoy to USD 181.7B. Trade surplus was at USD 97.9B

With the US, year-to-date, total trade dropped -0.6% to USD 401.5B. Exports dropped -0.8% yoy to USD 310.0B. Imports rose 0.2% yoy to USD 91.4B. Trade surplus was at USD USD 218.6B.

GBP/USD Mid-Day Outlook

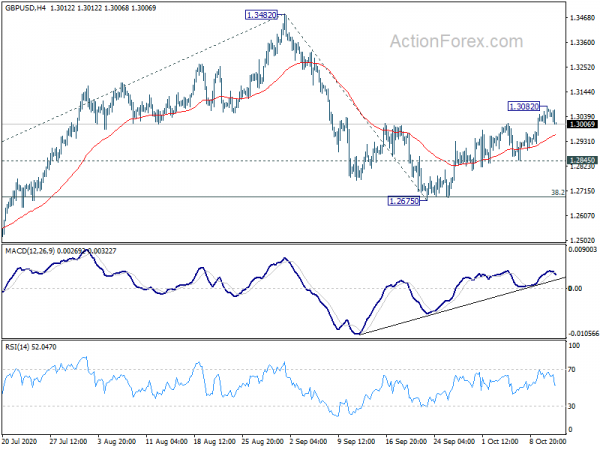

Daily Pivots: (S1) 1.3019; (P) 1.3051; (R1) 1.3097; More…

Intraday bias in GBP/USD is turned neutral with today’s retreat. Further rise is still expected as long as 1.2845 support holds. Break of 1.3082 will target 1.3482/3514 resistance zone next. Decisive break there will carry larger bullish implications and target 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956 next. On the downside, break of 1.2845 support will dampen this view and turn focus back to 38.2% retracement of 1.1409 to 1.3482 at 1.2690.

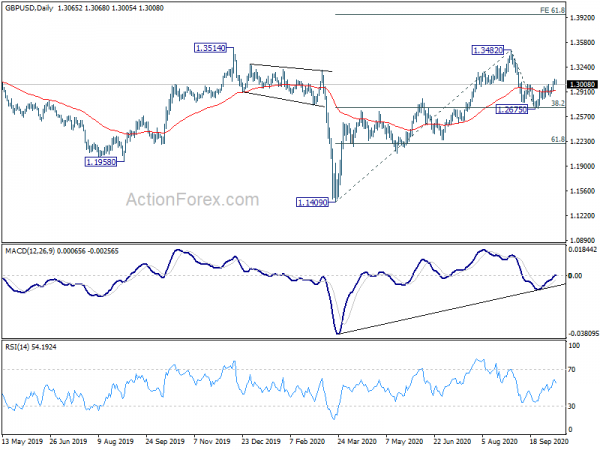

In the bigger picture, focus is back on 1.3415 key resistance now. Decisive break there should also come with sustained trading above 55 month EMA (now at 1.3312). That should confirm medium term bottoming at 1.1409. Outlook will be turned bullish for 1.4376 resistance and above. Nevertheless, rejection by 1.3514 will maintain medium term bearishness for another lower below 1.1409 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Sep | 6.10% | 4.70% | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Sep | 9.00% | 9.10% | 8.60% | |

| 03:06 | CNY | Trade Balance (USD) Sep | 37.0B | 59.3B | 58.9B | |

| 03:06 | CNY | Exports (USD) Y/Y Sep | 9.90% | 9.50% | ||

| 03:06 | CNY | Imports (USD) Y/Y Sep | 13.20% | -2.10% | ||

| 03:06 | CNY | Trade Balance (CNY) Sep | 258B | 420B | 417B | |

| 03:06 | CNY | Exports (CNY) Y/Y Sep | 8.70% | 11.60% | ||

| 03:06 | CNY | Imports (CNY) Y/Y Sep | 11.60% | -0.50% | ||

| 06:00 | GBP | Claimant Count Change Sep | 28K | 73.7K | ||

| 06:00 | GBP | Claimant Count Rate Sep | 7.60% | 7.60% | ||

| 06:00 | GBP | ILO Unemployment Rate 3M Aug | 4.50% | 4.30% | 4.10% | 4.30% |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Aug | 0.00% | -0.50% | -1.00% | |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Aug | 0.80% | 0.60% | 0.20% | |

| 06:00 | EUR | Germany CPI M/M Sep F | -0.20% | -0.20% | -0.20% | |

| 06:00 | EUR | Germany CPI Y/Y Sep F | -0.20% | -0.20% | -0.20% | |

| 09:00 | EUR | Germany ZEW Economic Sentiment Oct | 56.1 | 74 | 77.4 | |

| 09:00 | EUR | Germany ZEW Current Situation Oct | -59.5 | -60 | -66.2 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Oct | 52.3 | 70.5 | 73.9 | |

| 10:00 | USD | NFIB Business Optimism Index Sep | 104 | 100.9 | 100.2 | |

| 12:30 | USD | CPI M/M Sep | 0.20% | 0.20% | 0.40% | |

| 12:30 | USD | CPI Y/Y Sep | 1.40% | 1.40% | 1.30% | |

| 12:30 | USD | CPI Core M/M Sep | 0.20% | 0.20% | 0.40% | |

| 12:30 | USD | CPI Core Y/Y Sep | 1.70% | 1.70% | 1.70% |