These are the main highlights of the CFTC Positioning Report for the week ended on October 6h:

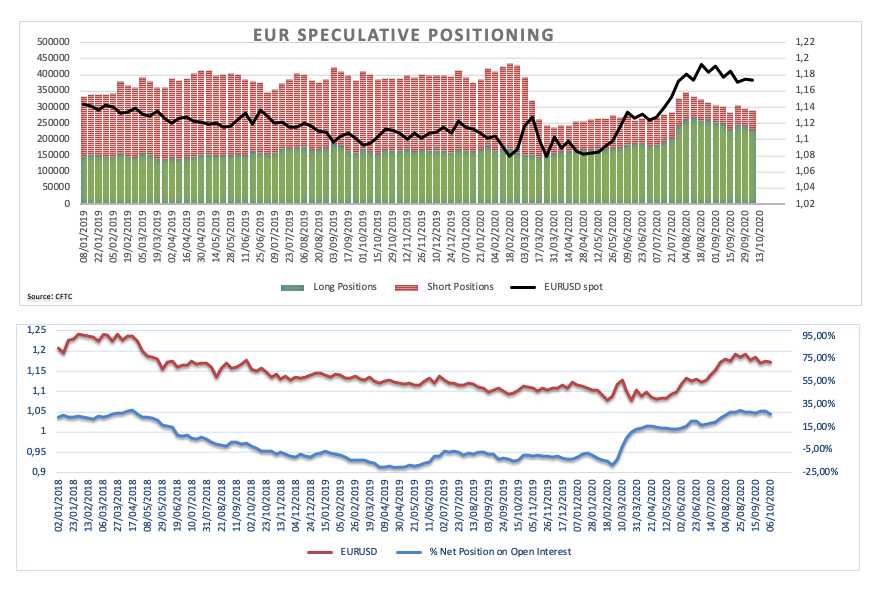

- Net longs in EUR receded to levels last seen in late July. Concerns over the second wave of the coronavirus and its impact coupled with increasing restrictions already in place by several countries appear to have undermined the confidence of a rapid economic recovery in the region. In addition, the recent dovish tone from the ECB might have played against the European currency as well.

- USD net shorts dropped to the lowest level so far this year around 3K contracts. Fears that the pandemic could undermine the recovery appear to have lent some support to the buck in past sessions. However, the selling sentiment around the dollar could well come back pari passu with further consensus of a Biden win, as this view is already perceived as negative for the greenback.

- Still in the safe haven universe, speculators trimmed their gross longs in JPY for the third week in a row, taking the net position to 4-week lows around 21.1K contracts. Regarding CHF, net longs stayed pretty much unchanged at 2-week highs.

- Net longs in Gold rose to the highest level since July 21st following concerns over the health of President Trump and the unremitting advance of the COVID-19 pandemic.

This article was originally published by Fxstreet.com. Read the original article here.

#shorts #crypto #forex #trading #patterns

#shorts #crypto #forex #trading #patterns