Forex news for North American trading on October 9, 2020.

Oh Canada! The US

employment data was released last Friday, so Canada had all the

attention to itself today when they released their jobs report for the

month of September. The numbers did not disappoint. The net

change in employment rose by 378.2K vs. expectations of

150K. Most of the job gains were in full-time employment with a

gain of 334K (vs. 205.8 K last month). Part-time jobs rose by

44.2K. The unemployment rate fell sharply to 9.0% from 10.2% last

month and much lower than the 9.8% expectations. Hourly

wages increase by 5.4%. The participation rate rose to 65% from

64.6% last month. All was good news.

The number sent the CAD

higher/the USDCAD lower. Moreover, the move helped to kick

start a dollar lower trend that continued in the other

currencies in trading today.

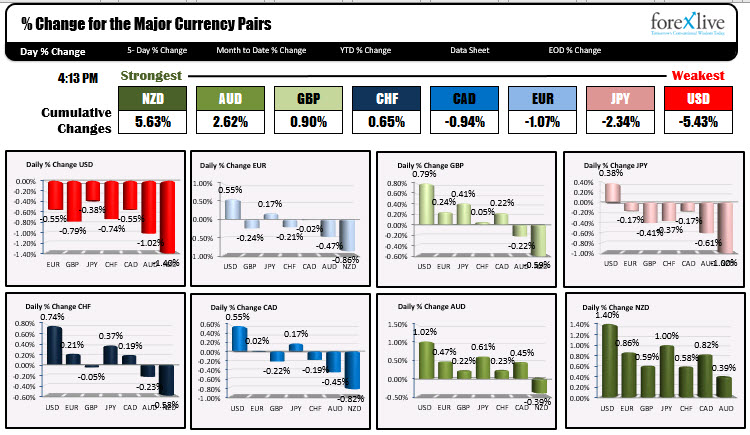

Looking at the strongest and

weakest currency rankings (see chart above), the USD is ending the day as

the weakest currency on the day by over doubled the

margin from the next weakest. The NZD was the strongest.

The dollar

fell partly on the back of “risk on ” sentiment.

US stocks market rose smartly once again with the major

indices close at the highest level since September 2.. That helped

to send flows into currencies like the NZD and AUD.

The dollar may also be

lower because Washington lawmakers (and the President) seem to be playing

a game on the stimulus where nothing gets done. This week the President

went from “I am calling off all stimulus negotiations until

after the election” on Tuesday, to “I want to provide more aid

than either party is offering”. Meanwhile, Senator McConnel says the

GOP does not want to go over $1.8T. The Dems are at $2.2T and both have other

requirements like aid to state and local government for the Dems, and “no

liability” for the GOP. PS later toward the close the White

House spokesperson said that the White House was now looking for $1.8

trillion max deal (and not better than all of the other deals) .

Do you ever get the feeling where

there is so much sarcasm going around that it’s hard to tell the

truth from reality?

I get the feeling neither

party wants a deal, but that’s not stopping them spewing

off a bunch of lies in the process.

Who knows maybe there will be a

surprise deal over the weekend, but if the pundits are right, the Dems

have one agenda, the GOP another, and now the President a

third. At the end of the day, the GOP – who controls the senate – will have

to approve and vote on a deal at least until January. The

election results in 3+ weeks will decide who controls Washington at that

point. In the meantime, I can’t help but think the president

will be doing all he can to prop up the stock market, and the Dems will do all

they can to shift blame on the President.

Some technical thoughts on the

major currencies:

- EURUSD: The

EURUSD surged above a downward sloping trendline on the hourly

chart at around 1.1797 and then the high price for the week at

1.18075 and the 50% midpoint of the move down from the September 1

high. That level comes in at 1.1811. Going into the new week

staying above the midpoint would keep the buyers firmly in

control. The next upside target would come in at 1.1858. That is the

61.8% retracement of the same move down. - GBPUSD: The GBPUSD traded to

the highest level since September 8 as the clock ticks

toward the October 15 ”drop dead” date imposed by PM

Johnson with issues (like fishing) still to be resolved. The price

action today moved above a swing area between 1.2999 and 1.3006

that has capped the pair going back to September 11.

That area is now support and a risk defining levels for longs. Stay above,

and the buyers are in control. Move below and the sellers are back in the

game. The pair is up testing a topside trend line on the hourly chart

(connecting highs from October 1 and October 6) at 1.3040 (and moving

higher). In the new week, that level will be the closest barometer for

bulls and bears. More upside momentum will have traders eyeing

the 50% midpoint of the move down from the September 1 high

at 1.30777. A move above that level opens the door for further

upside potential. - USDJPY: The USDJPY did not

find sellers of the JPY (buyers of the USDJPY) on risk on sentiment, but

instead saw the pair move lower with the overall dollar selling. The

pair cracked below its 100 hour moving average at 105.822 in the

early New York sessionand quickly scooted down to test the 200 hour

moving average at 105.672. After consolidating above and below that

moving average level for a few hours, sellers reentered in the

New York afternoon pushing the pair down to session lows at

105.57.Technically, the 200 hour moving

average (at 105.672) will be resistance in the new

trading week. A move above that level would have traders looking

back toward the 100 hour moving average at 105.822. On the

downside the next key target comes in at 105.519. That is the 50%

midpoint of the range for the month of October. Get below that

level should open up the door for further downside. - NZDUSD: The NZD was the

strongest currency, and the NZDUSD was the biggest mover with a gain of

1.4% on the day. That move got a shove higher in the NY

session when the pair moved above near converged 100 and 200 hour MAs at

0.6610 area. The subsequent run to the upside was able to extend

above the 50% retracement of the range since September 18.

That level came in at 0.66539. Swing highs from October 1,

October 2, October 5 and October 6 all came between 0.6653

and 0.6657. That ceilingwas also broken. In the new trading

week staying above 0.6653 will be more bullish. Move

below and there could be some further

corrective downside momentum. On more upside,

swing levels from mid-September come in between

0.6674 and 0.6683. The 61.8% retracement of the move down

from the September 18 high comes in at 0.66877. Get above that

level and further upside momentum can be expected. - USDCAD: The

USDCAD peaked on Wednesday and trended

lower since that high at 1.33397. The low price of the last hour of trading at 1.3116. Technically, the pair fell below its 61.8% retracement of the range since September 1. That level comes in at 1.31556. Stay below that level in the new week of trading and the sellers remain in control. On the downside the end of day selling took the price below swing areas from mid-September between 1.3118 and 1.3126. That will be close resistance in the new trading week. Staying below 1 of traders looking toward the September lows which extend all the way down to 1.2993.

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts

for beginner #shorts #crypto #forex #patterns #trading

for beginner #shorts #crypto #forex #patterns #trading