UK monthly GDP data for August shows that the economy grew at a pace of less than half compared to estimates

It looks like the UK economic recovery has peaked in the summer and things are looking less rosy as we head towards the tail-end of Q3 and going into Q4.

Although the report earlier points to some concerns surrounding the pace of the recovery, looking at historical data is arguably the least of the pound’s concerns right now.

The main focus remains on Brexit currently, but there is also fears of a second virus wave in the UK and then the possibly lack of fiscal support once the furlough program expires.

Add all of that on top of a flagging recovery, it will amplify any negative developments in the coming weeks and that could weigh on the pound from a fundamental perspective.

That said, recent price action in the pound has proven to be extremely resilient despite the pessimism on the Brexit front.

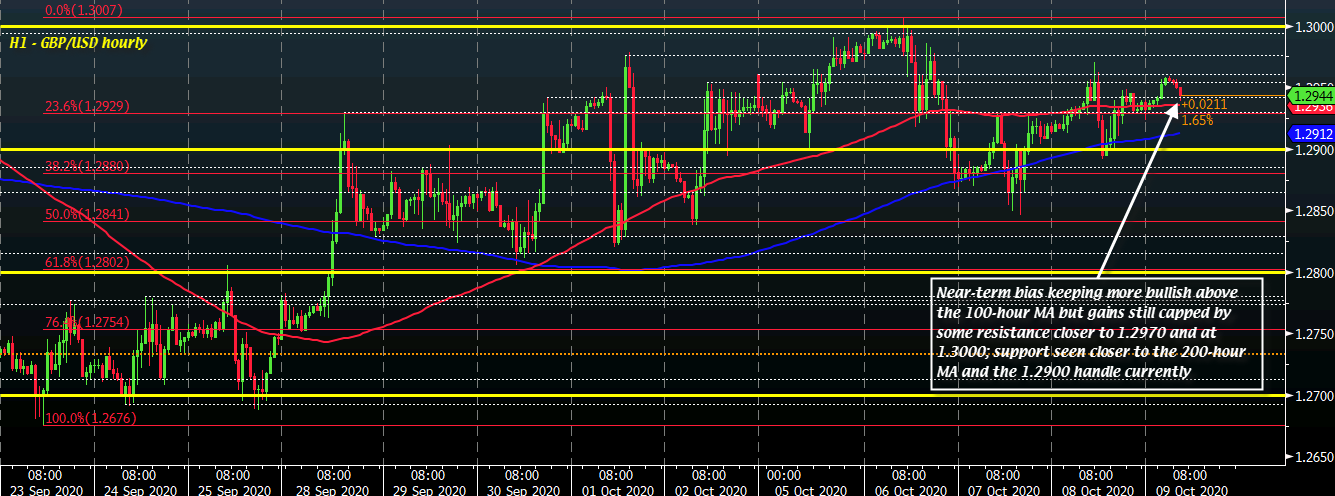

Cable is still resting just above its 100-hour MA (red line) right now as buyers keep near-term control while largely keeping a defense of the 200-hour MA (blue line).

Support at 1.2900 also helped to alleviate some pressure in trading yesterday, but buyers are also still lacking firm conviction to break above 1.3000 for now.

If anything, the pound looks positioned in a way that it wants to jump on any optimistic developments but at the same time is being a little more cautious in case there are setbacks to follow over the next week or so.