Global markets are clearly staying in risk-off mode before weekly close. Mixed US job data was largely ignored. Eyes are staying on the development regarding US President Donald Trump’s coronavirus infections, and the impact on the Presidential election which is just around a month away. Yen is currently the strongest one for today, but hasn’t break any important level yet. Sterling and Dollar and both firm too. On the other hand, commodity currencies are the weakest ones as led by Aussie.

Technically, 104.92 minor support in USD/JPY remains a focus and break could either drag down other Yen crosses, or push Dollar lower, or both. 1920 resistance in Gold is another level to watch, which could sign return to selloff in Dollar. As for stocks, S&P 500’s near term rebound is still safe as long as it could close above 55 day EMA at 3318. But a close below could spell more trouble next week.

In Europe, currently, FTSE is down -1.02%. DAX is down -1.26%. CAC is down -1.01%. German 10-year yield is down -0.016 at -0.549. Earlier in Asia, Nikkei dropped -0.67%. Singapore Strait Times dropped -0.19%. Hong Kong and China were on holiday. Japan 10-year JGB yield rose 0.0059 to 0.021.

– advertisement –

US NFP grew 66k1, unemployment rate dropped to 7.9%

US non-farm payroll employment grew 661k in September, below expectation of 875k. Though, August’s figure was revised up from 1371k to 1489k. BLS also said notable job gains occurred in leisure and hospitality, in retail trade, in health care and social assistance, and in professional and business services.

Unemployment rate dropped to 7.9%, down from 8.4%, beat expectation of 8.3%. Unemployed persons dropped -1m to 12.6m. Both measure declined for the 5th month but were higher than pre-pandemic level of 4.4% and 6.8m respectively. Labor force participation rate dropped -3% to 61.4%. Average hourly earnings rose just 0.1% mom, below expectation of 0.4% mom.

Eurozone CPI dropped further to -0.3% yoy in Sep, missed expectations

Eurozone CPI dropped further to -0.3% yoy in September, down from August’s -0.2% yoy, missed expectation of -0.1% yoy. Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in September (1.8%, compared with 1.7% in August), followed by services (0.5%, compared with 0.7% in August), non-energy industrial goods (-0.3%, compared with -0.1% in August) and energy (-8.2%, compared with -7.8% in August).

Separately, ECB Vice President Luis de Guindos said, “:inflation will be negative for the rest of the year”. Though, “for the coming year, we hope that it will recover”.

ECB Panetta: A digital Euro is a symbol of embracing change and lead from the front

In a blog post, ECB Executive Board member Fabio Panetta said, “we should be ready to issue a digital euro if and when developments around us make it necessary. This means that we already need to be preparing for it.”

“In the coming months, we will listen and experiment so that we are in a position to take a fully informed decision on the possible development and launch of a digital euro,” he added.

Though he also noted, “a digital euro would complement cash, not replace it. Together, they would offer people greater choice and easier access to means of payment. This would help financial inclusion. A digital euro would also be a symbol of Europe’s willingness to embrace change and lead from the front, supporting the digitalisation of the European economy.”

Japan unemployment rate rose to 3% in Aug, highest since 2017

Japan unemployment rate rose to 3.0% in August, up from 2.9%, matched expectations. That the highest level since 3.1% in May 2017. Jobs-to-applicants ratio fell to 1.04, down from 1.08, hitting the lowest level since January 2014. Consumer confidence rose to 32.7 in September, up from 29.3, but missed expectation of 33.8.

The unemployment remained relatively low by global standard. Yet, there are concerns of further slowdown in recovery in the job markets, and unemployment rate could rise further. While worsening conditions call for more government support, Finance Minister Taro Aso insisted that he’s not considering a third extra budget at present, as funds in the second package wasn’t used up yet.

Australia retail sales dropped -4% mom in Aug, all industries fell

Australia retail sales dropped -4.0% mom in August 2020, more than reversing the 3.2% mom rise in July. Victoria, which faced stage 3 and 4 restrictions, dropped -12.6% mom. Decline was also recorded in New South Wales (-2.0%), Queensland (-1.1%), South Australia (-0.9%), Western Australia (-0.4%), and Tasmania (-0.2%). sales rose only in The Northern Territory (2.0%), and the Australian Capital Territory (0.7%)

All industries fell, including household goods retailing (-6.0%), other retailing (-5.1 per cent), clothing, footwear and personal accessory retailing (-10.5 per cent), cafes, restaurants and takeaway food services (-6.6%), and department stores (-8.9%) saw large falls. Food retailing (-0.2%) saw a minor fall.

USD/JPY Mid-Day Outlook

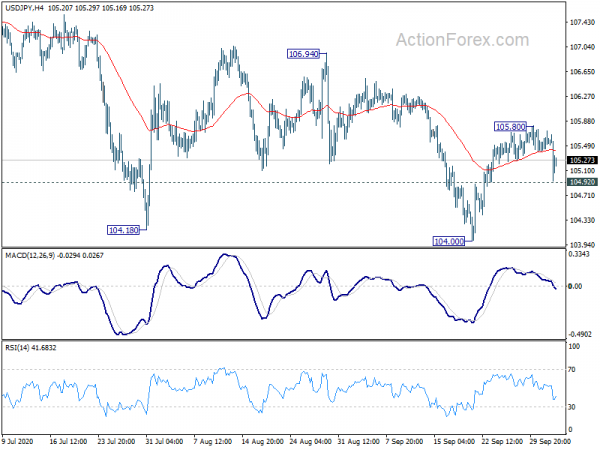

Daily Pivots: (S1) 105.40; (P) 105.57; (R1) 105.72; More...

Intraday bias in USD/JPY remains neutral with focus on 104.92 support. Firm break there will indicate that rebound from 104.00 has completed. Intraday bias will be turned back to the downside for 104.00. Break there will resume larger down trend from 111.71. On the upside, though, break of 105.80 resistance will resume rebound from 104.00 to 106.94 resistance, to confirm completion of the near term down trend.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 resistance should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Aug | 3.00% | 3.00% | 2.90% | |

| 23:50 | JPY | Monetary Base Y/Y Sep | 14.30% | 11.90% | 11.50% | |

| 01:30 | AUD | Retail Sales M/M Aug | -4.00% | 3.20% | 3.20% | |

| 05:00 | JPY | Consumer Confidence Index Sep | 32.7 | 33.8 | 29.3 | |

| 09:00 | EUR | Eurozone CPI Y/Y Sep P | -0.30% | -0.10% | -0.20% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep P | 0.20% | 0.50% | 0.40% | |

| 12:30 | USD | Nonfarm Payrolls Sep | 661K | 875K | 1371K | 1489K |

| 12:30 | USD | Unemployment Rate Sep | 7.90% | 8.30% | 8.40% | |

| 12:30 | USD | Average Hourly Earnings M/M Sep | 0.10% | 0.40% | 0.40% | 0.30% |

| 14:00 | USD | Michigan Consumer Sentiment Index SepF | 78.9 | 78.9 | ||

| 14:00 | USD | Factory Orders M/M Aug | 1.50% | 6.40% |