The GBP pairs had their spat of Brexit headline volatility, but other pairs not, not so much.

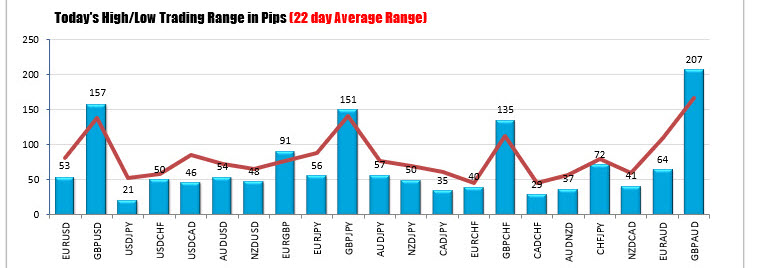

The major indices vs. the US dollar open the day with ranges less than 54 points with the exception of the GBPUSD, and that’s where the ranges have remained. In fact, looking at the major pairs at the start of the NY session the low to high ranges showed:

- EURUSD 53 pips

- GBPUSD 157 pips

- USDJPY 21 pips

- USDCHF 50 pips

- USDCAD 46 pips

- AUDUSD, 54 pips

- NZDUSD 48 pips

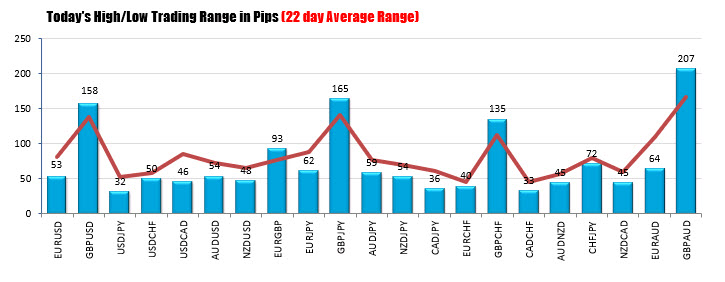

The ranges now shows:

- EURUSD, the same 53 pips

- GBPUSD 158 pips, the range was increased by 1 pip

- USDJPY 32 pips,. The very narrow range was increased by 11 pips

- USDCHF, the same 50 pips

- USDCAD, the same 46 pips

- AUDUSD, the same 54 pips

- NZDUSD, the same 48 pips

The major crosses are also little changed vs the early NY session.

The major crosses are also little changed vs the early NY session. So trading in the forex remains range bound and confined in ranges that are less than the average ranges (sans the GBP pairs).

Can there be a late day run?

Sure… the “market” does get tired of non trending, and with ranges contained it is not far for a break and run. What levels are in play for some of the pairs?

- EURUSD: The EURUSD stalled near the 50% retracement at 1.17641. A move with momentum above that level should ignite some buyer. Close resistance at 1.1755 (price is at 1.1743). On the downside falling below the 1.1713 level would take the price below a lower trend line on the hourly chart.

- USDJPY: Lower trend line at 105.42. On the topside, the high today stalled near swing highs from September 25, September 29 and a swing high from yesterday between 105.694 to 105.729. Get above should open up the upside.

- USDCHF: The low today stalled just ahead of the low from yesterday’s trade at 0.9162 (low today reached 0.91639). Ahead of that level on the downside sits the 50% retracement of the range since September 15 which comes in at 0.9173. Get below each of those levels should solicit more downside momentum. On the topside watch price action above the 0.9202. That was the broken 38.2% retracement of the same range since September 15

- USDCAD: The USDCAD trades just above its low from September 22 at 1.32827, and swing lows from today which ranged 1.32789 to 1.3283. There our 7 different hourly bar lows that bottomed in at 4-5 pip range today. Break below should solicit more selling. On the topside the high price today at 1.33214 was just short of the swing low going back to September 24 at 1.33238. A move above that area should solicit more buying.

- NZDUSD: The 50% retracement of the range since September 18 high comes in at 0.66539. A break above that level with momentum should solicit more buying. The earlier high for the day took a peek above the level only to fail (high reached 0.6656).

- AUDUSD: The AUDUSD stalled at the high today against a topside channel trendline. That trend line is now higher (around 0.74165 and moving higher). It would take a move above that level to solicit more buying. On the downside the lower channel trendline comes in at 0.7150. Break and stay below that line (it is rising) would be more bearish and should solicit more selling.

This article was originally published by Forexlive.com. Read the original article here.