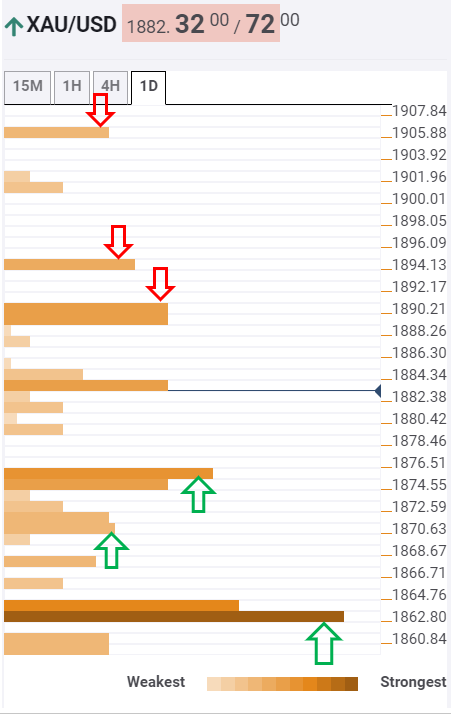

Gold Price Analysis: XAU/USD looks north, two key levels to watch out – Confluence Detector

Gold (XAU/USD) started out the US Non-Farm Payrolls (NFP) week on a solid footing, rallying nearly $20 on Monday. The metal bounced-off the SMA100 one-day support for the third straight day, courtesy of the broad retreat in the US dollar from two-month peaks.

The risk-on mood returned amid upbeat Chinese Industrial Profits data, lifting the sentiment on the global markets at the expense of the safe-haven greenback. Further, hopes of the US Congress reaching a fiscal stimulus deal also added to the broader market optimism.

Asia Update: Stocks fly as banks finally take off

Gold appeared to put in a good a base around $1,850 after a reasonably negative September, with the metal averaging a 1-2% move lower during the month in the past five years. It’s now down almost 5% on the month, and at slightly more compelling levels to enter into longs, given positions are much cleaner than even after last month sell-off.

Gold is up on a weaker US dollar, and more gains could be in the offing as focus shifts to US elections, political uncertainty and geopolitical risks.