Yen ended up broadly as the strongest one last week, extending this month’s rebound. Domestically, political uncertainty was cleared with Yoshihide Suga took up the job of Prime Minister, ensuring continuity of Abenomics. Externally, geopolitical risks at the South China Sea and Taiwan Strait heightened while US-China relations deteriorated further. Coronavirus infections came back with another surge in Europe. Stock markets looked vulnerable for deeper correction. There is prospect of more upside in the Yen ahead.

Sterling ended as one of the strongest, surviving dovish BoE. But that’s most likely just a corrective recovery as risks stay on the downside. Dollar attempted a rally after FOMC but quickly faded and ended mixed. Canadian Dollar was given no support from surging oil prices while Swiss Franc was surprisingly the weakest one.

– advertisement –

Dollar failed to extend post FOMC rally

Dollar attempted to rally last week after clearing FOMC risk, without any unexpected extra dovishness. The statement clearly reflected the idea of averaging inflation targeting, as Fed will “aim to achieve inflation moderately above 2% for some time so that inflation averages 2% over time”. The latest projections indicates that fed funds rate will stay at the current 0-0.25 % at least until 2023, which is unsurprising.

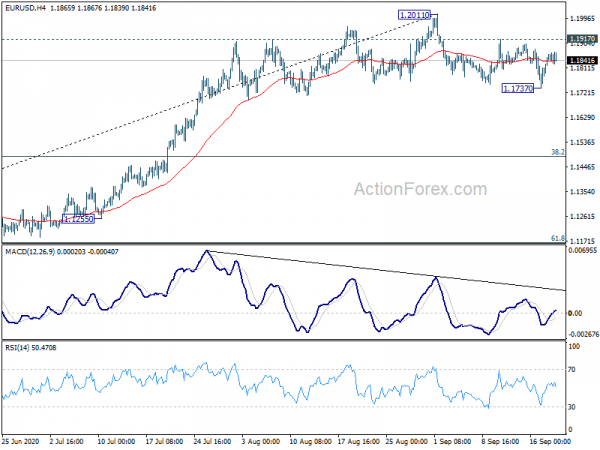

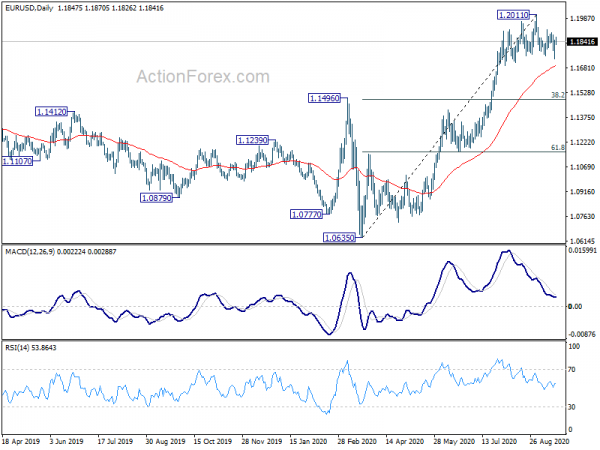

Yet, the greenback’s rally disappointed and faded quickly. Dollar index was tuck below 93.66 near term resistance, which keeps outlook bearish. The development was clearly reflected in EUR/USD, which dipped to 1.1737 but recovered. For now, outlook in DXY is unchanged that another fall below 91.74 cannot be ruled out. But firm break of 93.66 should at least start a correction to fall from 102.99 to 91.74, and target 38.2% retracement at 96.03.

Sterling survived BoE, but risks stay on downside

Sterling somewhat survived the dovish BoE rate decision last week, which hinted it’s stepping closer to negative interest rates. Pound recovered only because it was digesting prior week’s steep losses. Risk of no-deal Brexit remains while UK’s coronavirus infections are surging again.

Technically, Sterling is limited below some near term resistance levels against its counterparts. Those levels include 1.3035 minor resistance in GBP/USD. 136.58 minor resistance in GBP/JPY, 0.9067 minor support in EUR/GBP, 1.1831 minor resistance in GBP/CHF. More downside is still in favor in the pound.

In particular, developments in GBP/JPY argues that whole corrective rise from 123.94 has completed at 142.71. Deeper fall would be seen to 61.8% retracement of 123.94 to 142.71 at 131.11. Sustained break there will confirm this view and pave the way to retest 123.94.

More upside in Yen as stocks extend corrections

Considering the risk of deeper correction in stocks, there is prospect of further rally in Yen this week. In particular, NASDAQ’s close below 55 day EMA affirms the case that it’s already in correction to rise from 6631.42 to 12074.06. Deeper decline is expected as long as 11245.41 resistance holds, to 38.2% retracement of 9994.97, which is close to 10000 psychological level.

Australia All ordinaries also failed to rise back to above 55 day EMA. The development also argues that it’s in correction to rise from 44.29 to 6369.89 already. Break of 6015.89 support would pave the way to 38.2% retracement at 5628.50.

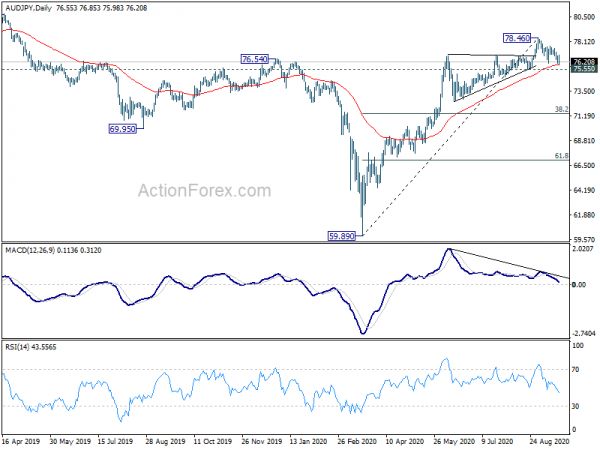

As AUD/JPY and ASX track each other quite well, the development also affirms that case that AUD/JPY is in correction to rise form 59.89 to 78.46. Break of 75.55 support will pave the way to 38.2% retracement at 71.36.

EUR/USD Weekly Outlook

EUR/USD dipped to 1.1737 last week but quickly recovered. The development dampened our immediate bearish view that it’s already correcting the rise from 1.0635. Initial bias remains neutral this week first. On the downside, below 1.1737 will reaffirm the bearish case and turn bias to the downside for 38.2% retracement of 1.0635 to 1.2011 at 1.1485. On the upside, though, break of 1.1917 will revive near term bullishness and bring retest of 1.2011 resistance first.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

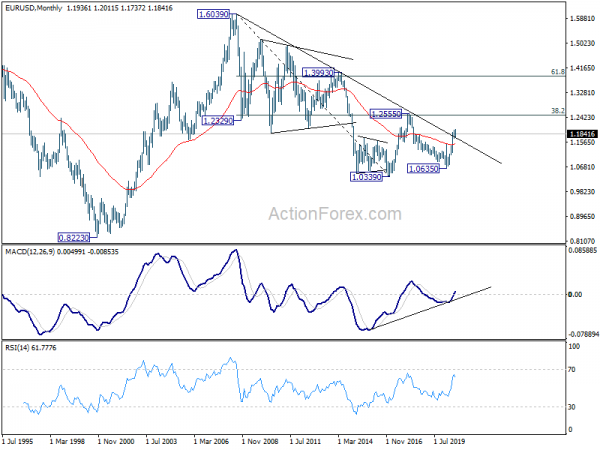

In the long term picture, the strong break of 55 month EMA is taken as a sign of long term trend reversal. Immediate focus will be on decade long trend line resistance (now at 1.1700). Sustained trading above there will add more credence to the case that down trend from 1.6039 (2008 high) has finished at 1.0339. Further break of 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ) will confirm and target 61.8% retracement at 1.3862 and above.