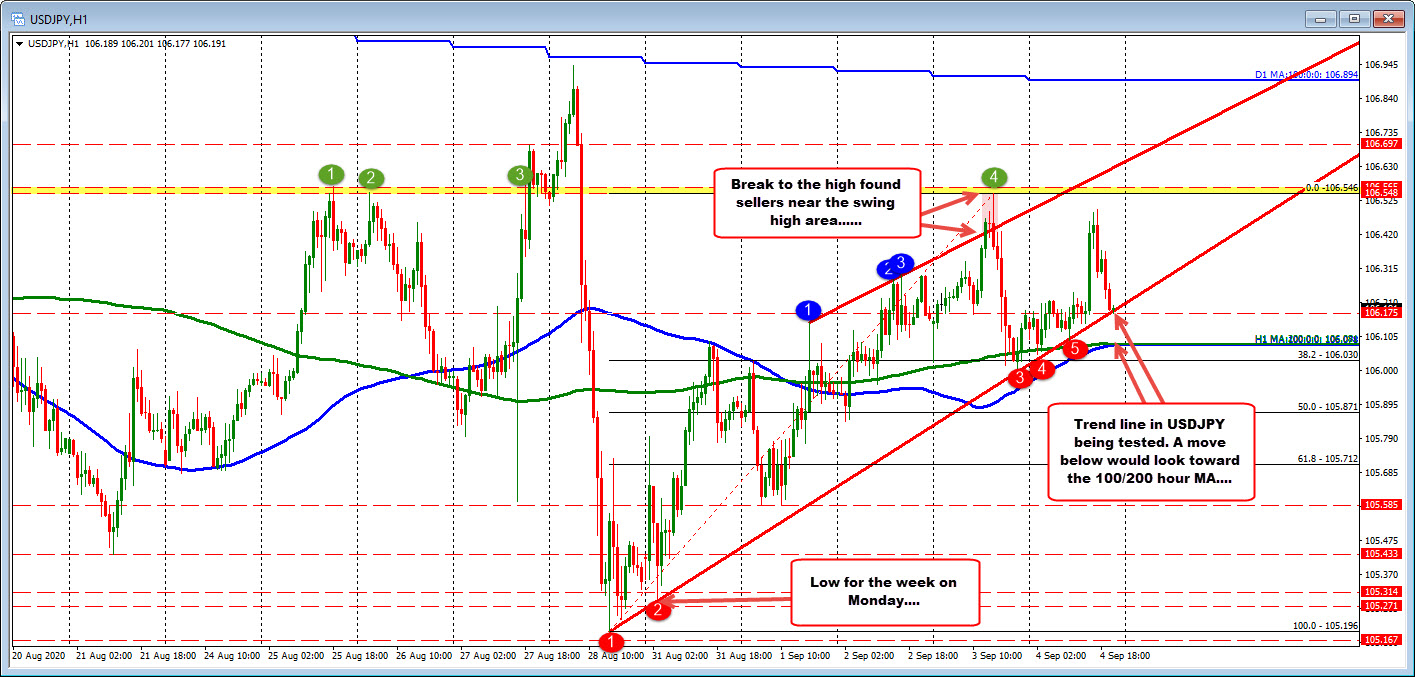

Rotation lower after spike higher stalls ahead of the week’s high

The USDJPY spiked higher in the early NY session on the dollar buying trend, but after the pair could not extend above the high from Thursday and USD selling returned, the price of the pair followed the leaders (or others) and moved back lower (lower dollar).

The move lower has now moved to test the trend line at 106.19 (see red numbered circles). A move below would see the price head toward the 100/200 hour MAs at 106.08 (both are converged at that level).

For the low was on Monday – ahead of the last Friday low at 105.196. The pair peaked on Thursday at 106.54. That level reached swing levels from August 25, 26 and 27 just before breaking higher. The pair tumbled back below that area on August 28th and has not tested the level until Thursday.

Today’s high stalled ahead of that swing area.

We are heading into the weekend. So anything can happen given liquidity conditions.

However, what we know technically, is if the trend line is broken, AND the 100 and 200 hour MAs are also broken, the sellers would wrestle mover control from the buyers. Stay above, however, and the buyers remain in control.