SoftBank up $4B

All the talk Friday was about SoftBank’s huge position in equity options and how it may have contributed to the blow-off moves we saw in the tech sector last week.

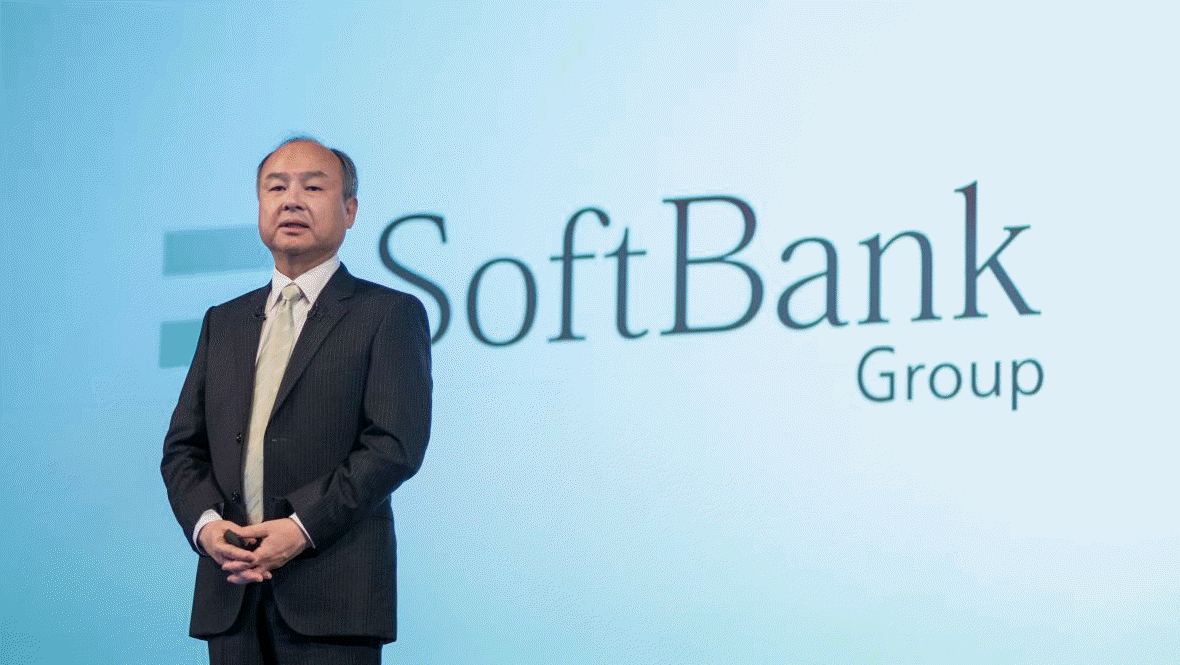

For all the attention it has gotten, that strikes me as a small number. Founder Masayoshi Son once lost $70B in the dot-com crash and the company is worth close to $100B. SoftBank lost $17.7B on WeWork and Uber last year.

The strategy has focused on options related to individual US tech stocks. In total, it has taken on notional exposure of about $30bn using call options – bets on rising stock prices that provide the right to buy stocks at a preset price on future dates. Some of this position has been offset by other contracts bought as hedges.

“It’s just a levered punt on the market,” said one person with direct

knowledge of the trades. “The whole strategy is just momentum buying.”

Without knowing the details of the trade — including the timeline — it’s tough to evaluate. However if the whole strategy is really just momentum buying, then Thurs/Fri showed how quickly it could blow up.

For me though, the whole thing is overblown. $30B is notional (again, depending on the details), really isn’t that much.