Nothing has been more impressive than the Mexican peso this week

If an asset can rally in a risk-positive and risk-negative environment, it’s probably poised for more. Nothing embodies that better than the Mexican peso this week. It rose as the US dollar weakened in the equity market euphoria and it powered through the strength in the US dollar yesterday and today.

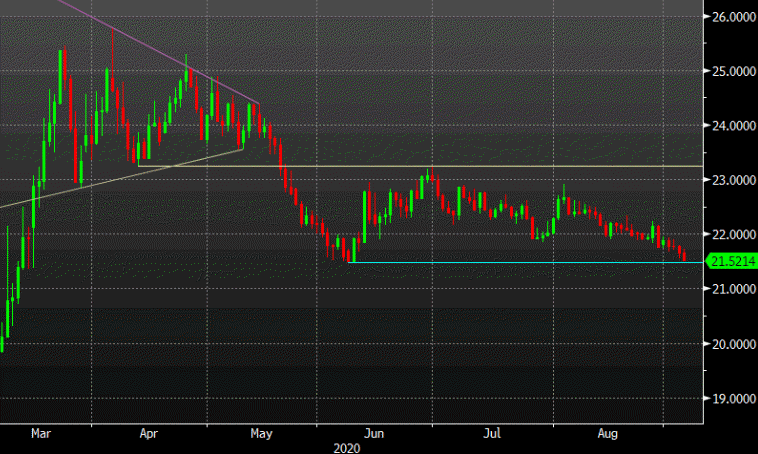

Now, USD/MXN is testing the major low set in June.

I don’t know if there’s a better trade out there right now than short USD/MXN. There is a long-term secular trend towards re-shoring that’s going to boost investment in Mexico because of USMCA access to the US market. In the shorter term, emerging market currencies are still far below pre-pandemic levels.

Certainly, Mexico has some domestic challenges but the peso is cheap by almost any measure and the price action this week demonstrates that in the strongest terms.

For the immediate trade, stay cautious until the June low of 21.47 breaks, but when it does, we could see another move like the May/June drop.