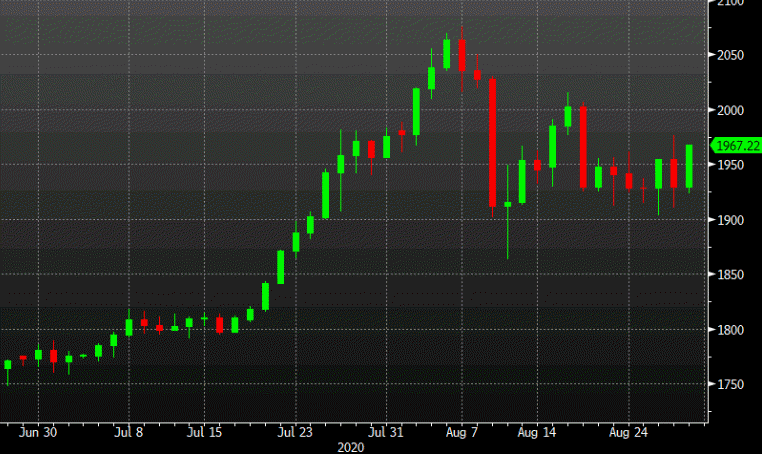

Gold up $37 to $1966

Gold is back in the saddle today and on track to close at the best levels since Aug 18.

It’s all about the dollar today as it trades off of that and Treasury yields. At the same time, you get the sense this is a market that’s really searching for a theme. The Fed tilted to a dovish forever model and it was back-and-forth. Then you have governments that are not sure what to do on the stimulus front and some optimism about the virus creeping in.

It all adds up to a bit of a range trade here, maybe until the US election.

In the shorter-term, yesterday’s spike high of $1976 is resistance.

This article was originally published by Forexlive.com. Read the original article here.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading