Continuation of the trend

One of the major divergences in markets in the past two months has been the lack of enthusiasm in emerging market currencies. Most — if not all — are way below pre-pandemic levels.

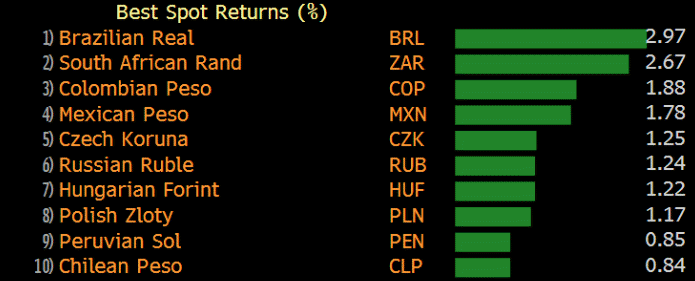

Among the laggards are the LatAm currencies, including BRL, MXN and COP. All three are near the top of the chart today and up strongly. That’s a very good sign for those beaten-down currencies, and also for risk assets in general.

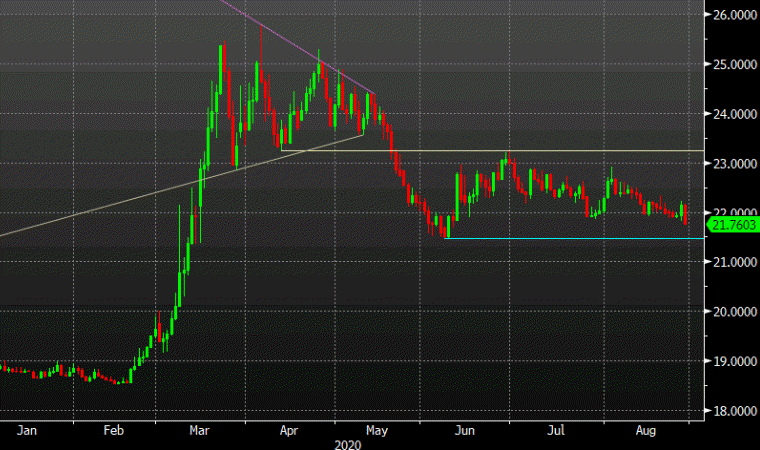

One I’m paying particularly close attention to — because I think it’s a long-term positive secular story — is the Mexican peso.

USD/MXN has hung out in a range since since breaking lower from a triangle formation in May. Now, it’s headed back to the lower end of the range.

I think there is a great case for shorts here, particularly if 21.47 breaks.