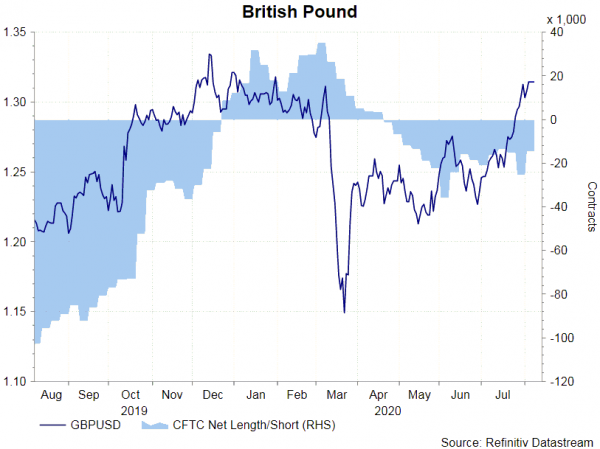

As suggested in the CFTC Commitments of Traders report in the week ended August 4, NET SHORT for USD Index futures decreased -252 to 6 475 contracts. Bets fell on both sides as the greenback is still finding bottom after losing almost -10% against a basket of currencies since March. Speculative long positions dropped -2 433 contracts and short positions were down -2 685 contracts. Concerning European currencies, NET LENGTH in EUR futures jumped +23 089 contracts to 180 648. NET SHORT for GBP futures declined -10 682 contracts to 14 727 for the week.

On safe-haven currencies, NET LENGTH on CHF futures jumped +3 218 contracts to 11 660. NET LENGTH on JPY futures gained +2 922 contracts to 31 429. Commodity currencies under our coverage remained in NET SHORT positions. AUD futures’ NET SHORT declined -3 964 to 1 048 contracts. Separately, NZD futures’ NET SHORT added +603 contracts to 1 448 during the week. Meanwhile, NET SHORT for CAD futures jumped +10 699 contracts to 23 195.

On safe-haven currencies, NET LENGTH on CHF futures jumped +3 218 contracts to 11 660. NET LENGTH on JPY futures gained +2 922 contracts to 31 429. Commodity currencies under our coverage remained in NET SHORT positions. AUD futures’ NET SHORT declined -3 964 to 1 048 contracts. Separately, NZD futures’ NET SHORT added +603 contracts to 1 448 during the week. Meanwhile, NET SHORT for CAD futures jumped +10 699 contracts to 23 195.