London/European traders exit

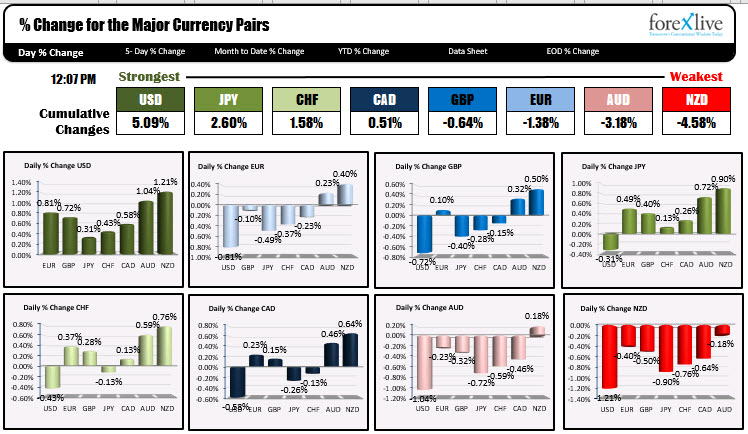

The USD is stronger but off the highs as London/European traders exit for the weekend. The greenback is the highest vs. the NZD (up 1.21%). It is the least high vs the JPY (up 0.31%). Versus the EUR, it is up 0.81% and is higher versus the GBP by 0.72%.

Technically speaking:

EURUSD: The EURUSD fell initially bottomed against its 200 hour moving average and swing area in the 1.17992 to 1.1805 area after the employment report and bounced. However, dollar buyers came in on the rebound and push the price below that key support area. The high correction since breaking 1.17962 – just below the low of that swing area. Sellers remain in control. We currently trade at 1.1779. The low for the day reached 1.17545.

GBPUSD: The GBPUSD in the London morning session fell below its swing area in the 1.3104 to 1.3110 area and the 100 hour moving average at 1.3098. After the employment data, the price did crack back up toward that area, and found sellers. Those sellers took the price below its 200 hour moving average (green line in the chart below) and down to another swing area at the 1.3003 to 1.3012 area. Buyers came in that area and the price rebounded back up to the 200 hour moving average where sellers have put a lid on it. That is the risk level for shorts now. Stay below the 200 hour moving average keeps the bears in control. Move below the 1.3000 area, and sellers gain more control with 1.2980 low for the week as the next target.

USDJPY: The USDJPY traded above and below its 100 hour moving average before and after the better-than-expected US jobs data. However, as the dollar started to move higher, so did the USDJPY. It moved up to the swing high level from July 31 (last Friday’s high) and found sellers against that level.

Looking at the daily chart, the 105.978 to 106.067 were lows from May and June as well. So it is and remains a key area (see daily chart below).