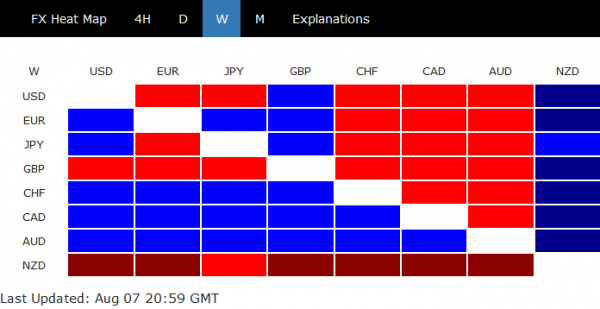

Dollar was under pressure most of the week on risk-on sentiments. NASDAQ gapped higher and marched to new record highs. Nevertheless, the greenback staged a notable comeback after combination move by the US administration against the Chinese Communist Party, with bans on TikTok and WeChat, as well as sanction on Hong Kong and Chinese officials. Still, the greenback couldn’t take out some near term resistance levels against other major currencies yet.

New Zealand Dollar ended as the worst performing one, thanks to cross selling against Aussie. Sterling followed as second and Dollar as third weakest. Australian Dollar was the strongest, lifted by strong rally in iron ore price. Canadian Dollar is the second strongest, as WTI crude oil breaks above key resistance at 42. We’ll see if Dollar could finally stage a sustainable rebound this week.

– advertisement –

Dollar index needs to break 93.99 resistance to confirm short term bottoming

Dollar index edged lower to 92.52 last week but recovered strongly on Friday. The weekly close at 93.43 was actually slightly higher than prior week’s 93.34. Together with the mild turn in daily MACD, a short term bottom could have been formed and a rebound is underway. Yet, it’s still too early to say and break of 93.99 resistance is needed to confirm this case. Otherwise, fall from 102.99 would still extend towards 88.25 support (2018 low). Firm break of 93.99 will bring stronger rebound back to 38.2% retracement of 102.99 to 92.52 at 96.52, which is inside 95.71/97.80 resistance zone.

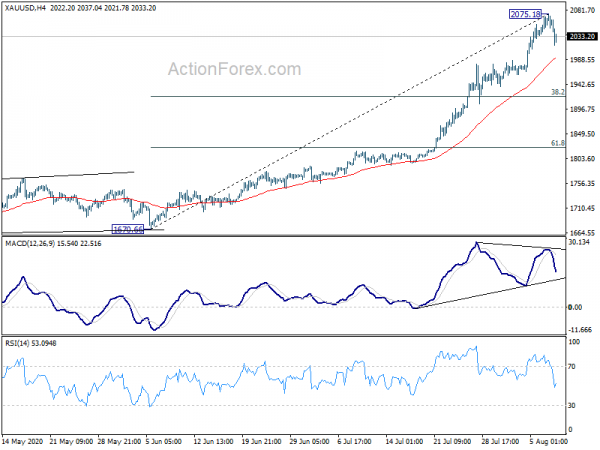

Gold topped in short term at record 2075.18

Gold also appeared to have made a short term top after making near record at 2075.18. 4 hour 55 MACD at 1991.51 will be the first line of defense for gold. Sustained break there should confirm that it’s in correction to the rally from 1670.66 to 2075.18. In this case, deeper decline would be seen to 38.2% retracement at 1920.65. This, if happens, will be seen by us as a confirmation of Dollar’s rebound.

Hong Kong HSI may further reflect US-China tensions

As the next move of Dollar could be driven by further escalation in US-China tension, we’ll keep an eye on the development in Hong Kong stocks too. HSI tumbled to as low as 24167.79 on Friday but drew support from a near term channel and recovered. But that was only the reaction to the ban of TikTok and WeChat. It hasn’t priced in the sanction of 11 Hong Kong officials by the US Treasury.

Another round of selloff as the week starts would likely take out the channel support firmly. That would argue that whole corrective rise from 21139.26 has completed with waves up to 26782.61. Steeper selling could be seen to 22519.73 support for confirmation. Though, break of 25201.43 resistance will clear near term downside risks for now.

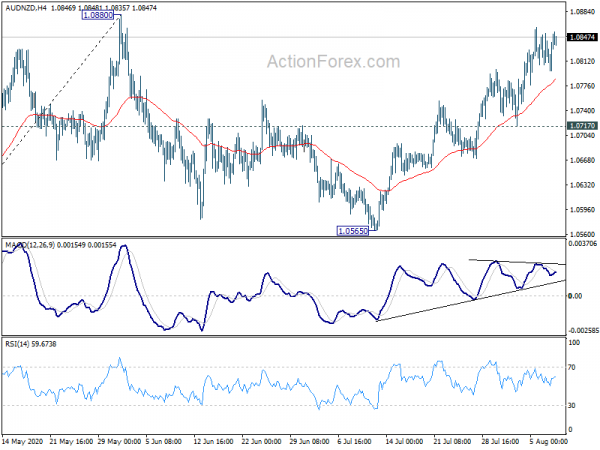

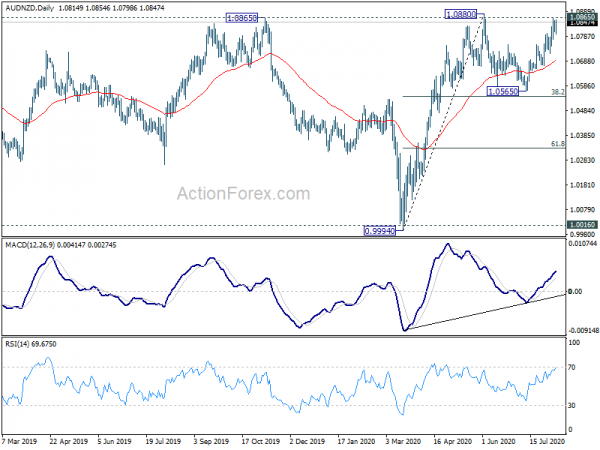

AUD/NZD and AUD/CAD approaching key resistance, with loss of momentum

In case that risk aversion starts and spreads from Asia, commodity currencies are something that worth a watch. While Australian Dollar has been outperforming Canadian and New Zealand Dollar, respective crosses are approaching key near term resistance, with loss of upside momentum. There is prospect for Aussie to lead the move lower.

AUD/NZD continued to gyrate higher last week but upside momentum was clearly diminishing as seen in 4 hour MACD, as it approaches 1.0880 resistance. Bear in ming that it’s also close to 1.0865 structural resistance, which is failed to sustain above once. Another rejection is possible and break of 1.0717 support will extend the consolidation form 1.0880 with another falling leg towards 1.0565 support.

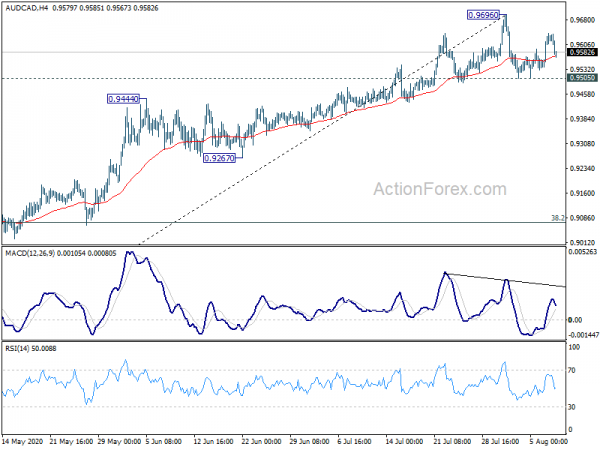

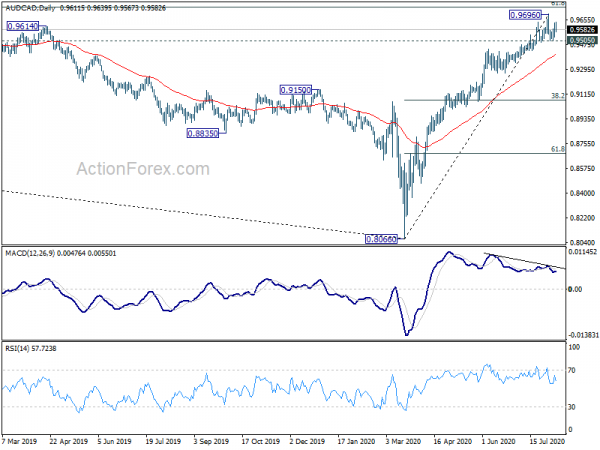

AUD/CAD has also been losing upside momentum as seen in both daily and 4 hour MACD. It’s now close to 61.8% retracement of 1.0784 (2012 high) to 0.8066 at 0.9746. A small head and shoulder top is also possibly information as seen in 4 hour chart. Break of 0.9505 would bring a correction to 38.2% retracement of 0.8066 to 0.9696 at 0.9073.

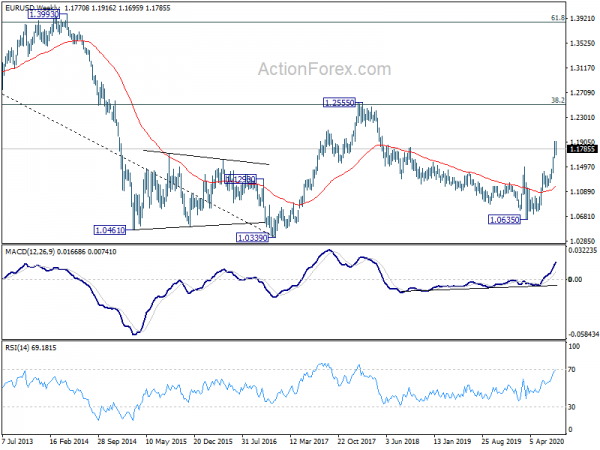

EUR/USD Weekly Outlook

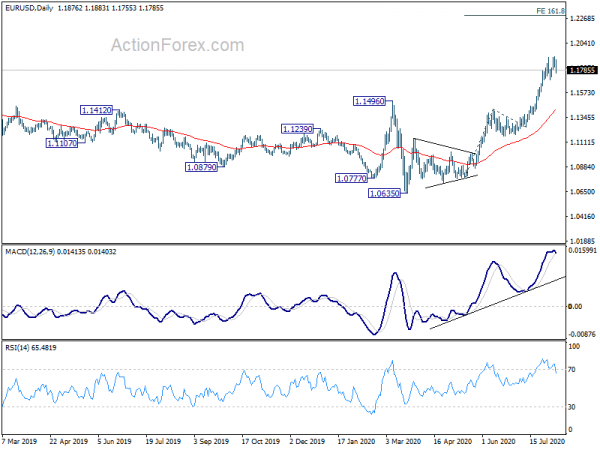

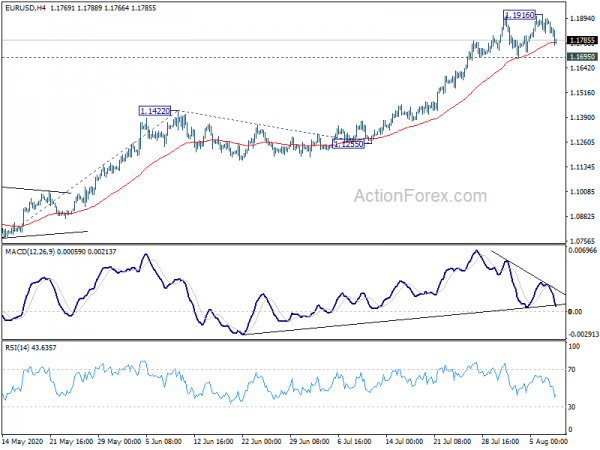

EUR/USD edged higher to 1.1916 last week but retreated since then. Initial bias remains neutral this week first. Further rise will remain in favor as long as 1.1695 support holds. On the upside, break of 1.1916 will target will extend larger rally from 1.0635 to 161.8% projection of 1.0774 to 1.1422 from 1.1255 at 1.2303. However, firm break of 1.1695 should confirm short term topping. Intraday bias will be turned back to the downside to wards 1.1422 resistance turned support.

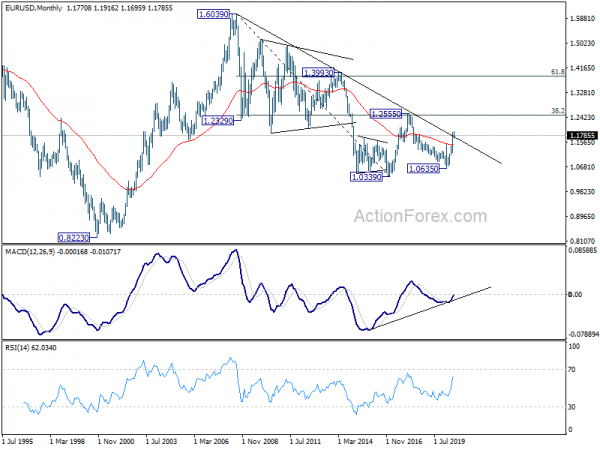

In the bigger picture, down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise form 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

In the long term picture, the strong break of 55 month EMA is taken as a sign of long term trend reversal. Immediate focus will be on decade long trend line resistance (now at 1.1748). Sustained trading above there will add more credence to the case that down trend from 1.6039 (2008 high) has finished at 1.0339. Further break of 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ) will confirm and target 61.8% retracement at 1.3862 and above.