Dollar is having another rally attempt today and appears to be making some progress, at least against the relatively weaker Sterling. At this point, Swiss Franc is the strongest one, followed by the greenback. Australian Dollar is also firm after a non-eventful RBA rate decision. On the other hand, the Pound is the weakest one. New Zealand Dollar is the second weakest, partly due to cross selling against Aussie. Kiwi is also cautious ahead of tomorrow’s job data.

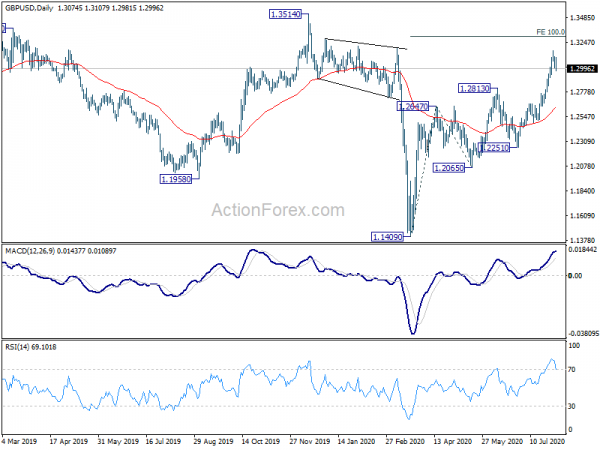

Technically, GBP/USD’s break of 1.3013 minor support suggests short term topping and deeper fall could be seen towards 1.2813 cluster support. That’s helped by GBP/JPY’s retreat ahead of 139.73 resistance, as well as EUR/GBP’s recovery. The greenback still need to overcome some levels to confirm it’s underlying moment. Those levels include 1.1698 minor support in EUR/USD, 0.7063 support in AUD/USD, 0.9241 minor resistance in USD/CHF and 1.3459 minor resistance in USD/CAD. At the same time, 1939.20 support in Gold will also be watched to verify Dollar’s rebound.

In Europe, currently, FTSE is down -0.14%. DAX is down -0.85%. CAC is down -0.34%. German 10-year yield is down -0.0269 at -0.549. Earlier in Asia, Nikkei rose 1.70%. Hong Kong HSI rose 2.00%. China Shanghai SSE rose 0.11%. China Shanghai SSE rose 1.24%. Japan 10-year JGB yield dropped -0.0085 to 0.015.

– advertisement –

ECB Lane: PEPP envelop determines the overall monetary stance, not monthly purchases

In a blog post, ECB chief economist Philip said despite some rebound in activity, “the level of economic slack remains extraordinarily high and the outlook highly uncertain.” “Further progress in persistently containing the virus will be central in determining the size and speed of the economic recovery, together with sufficiently-supportive fiscal and monetary policies.”

He hailed that the recently agreed Next Generation EU instrument will be “vitally important in ensuring sufficient fiscal support across EU Member States in the coming years”. For ECB’s part, the central bank is “committed to providing the monetary stimulus needed to support the economic recovery and secure a robust convergence of inflation towards our medium-term aim.”

Lane downplayed the recent lower pace of PEPP purchases in July, “the usual summer lull” in market activity. He emphasized that “the overall envelope of PEPP purchases is a core determinant of the ECB’s overall monetary stance”.

Eurozone PPI at 0.3% mom, -3.7% yoy in June

Eurozone PPI rose 0.7% mom in June, above expectation of 0.5% mom. Annually, CPI dropped -3.7% yoy, better than expectation of -3.9% yoy. Over the month, prices in Eurozone increased by 3.1% mom in the energy sector, by 0.2% mom for intermediate goods and by 0.1% mom for capital goods, while prices remained stable for durable consumer goods and decreased by -0.1% mom for non-durable consumer goods. Prices in total industry excluding energy remained stable.

EU PPI rose 0.7% mom, down -3.4% yoy. The highest increases in industrial producer prices were recorded in Estonia (+3.7% mom), Denmark (+3.3% mom) and Finland (+2.2% mom), while the only decreases was observed in Czechia (-0.1% mom).

Also released, Swiss SECO consumer climate rose to -12 in Q3, up from -39.3.

RBA stood pat, expects uneven and bumpy recovery

RBA left monetary policy unchanged as widely expected, keeping both the cash rate and 3-yr AGS yield target at 0.25%. The central bank also pledged that the “accommodative approach will be maintained as long as it is required”. It “will not increase the cash rate target until progress is being made” on full employment and inflation.

RBA reiterated that the economic downturn is “not as severe as early expected”. However, the recovery is likely to be “both uneven and bumpy” with the coronavirus outbreak in Victoria having a “major effect” on its economy.

In the baseline scenario, output falls by -6% over 2020 then grow 5% in 202. Unemployment rate will hit around 10% later this year due to job losses in Victor. Unemployment rate is expected to gradually decline to around 7% over the following couple of years. Inflation is expected to stay below 2% target over the next couple of years in all scenarios considered.

Suggested readings:

Australia retail sales rose 2.7% in June, dropped -3.4% in the quarter

Australia retail sales rose 2.7% mom in June, above expectation of 2.4% mom. Over the June quarter, however, retail volumes stilled dropped -3.4% qoq. That’s the largest seasonally adjusted quarterly decline since the introduction of the GST in 2000.

Exports of goods and services rose 3% mom to AUD 26.2B while imports rose 1% mom to AUD 28.0B. Trade surplus widened slightly to AUD 8.2B, but missed expectation of AUD 8.8B.

BoJ Kuroda: Risks are high with increasing coronavirus infections outside Tokyo

According to an interview by Yomiuri newspaper, BoJ Governor Haruhiko Kuroda warned that risks to economic recovery in Japan is high. He pointed to the increasing coronavirus infections outside of Tokyo, the capital city. The central bank is considering the extend the March 2021 deadline for lending facilities that supports companies hit by the pandemic. Kuroda also reiterated the options of further easing, including expanding loan scheme, cutting short-, long-term rate targets, ramping up ETF buying etc.

Separately, Tokyo CPI climbed to 0.6% yoy in July, up from 0.3% yoy. CPI core also rose to 0.4% yoy, up from 0.2% yoy, beat expectation of 0.2% yoy. Monetary base rose 9.8% yoy in July, well above expectation of 6.3% yoy.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3017; (P) 1.3065; (R1) 1.3125; More….

GBP/USD’s break of 1.3013 minor support suggest short term topping in 1.3170. Intraday bias is back on the downside for 4 hour 55 EMA (now at 1.2941) and below. Downside should be contained by 1.2813 cluster support (38.2% retracement of 1.2251 to 1.3170 at 1.2819) to bring rebound. On the upside, break of 1.3170 will resume larger rise from 1.1409 to 100% projection of 1.1409 to 1.2647 from 1.2065 at 1.3303 next.

In the bigger picture, while the rebound from 1.1409 is strong, there is not enough evidence for trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. However, decisive break of 1.3514 should at least confirm medium term bottoming and turn outlook bullish for 1.4376 resistance first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Jul | 0.40% | 0.20% | 0.20% | |

| 23:50 | JPY | Monetary Base Y/Y Jul | 9.80% | 6.30% | 6.00% | |

| 0:30 | AUD | Retail Sales M/M Jun | 2.70% | 2.40% | 2.40% | |

| 1:30 | AUD | Trade Balance (AUD) Jun | 8.20B | 8.80B | 8.03B | 7.34B |

| 4:30 | AUD | RBA Rate Decision | 0.25% | 0.25% | 0.25% | |

| 5:45 | CHF | SECO Consumer Climate Q3 | -12 | -39.3 | ||

| 9:00 | EUR | Eurozone PPI M/M Jun | 0.70% | 0.50% | -0.60% | |

| 9:00 | EUR | Eurozone PPI Y/Y Jun | -3.70% | -3.90% | -5.00% | |

| 13:30 | CAD | Manufacturing PMI Jul | 47.8 | |||

| 14:00 | USD | Factory Orders M/M Jun | 5% | 8% |