Weekly FX speculative positioning data from the CFTC

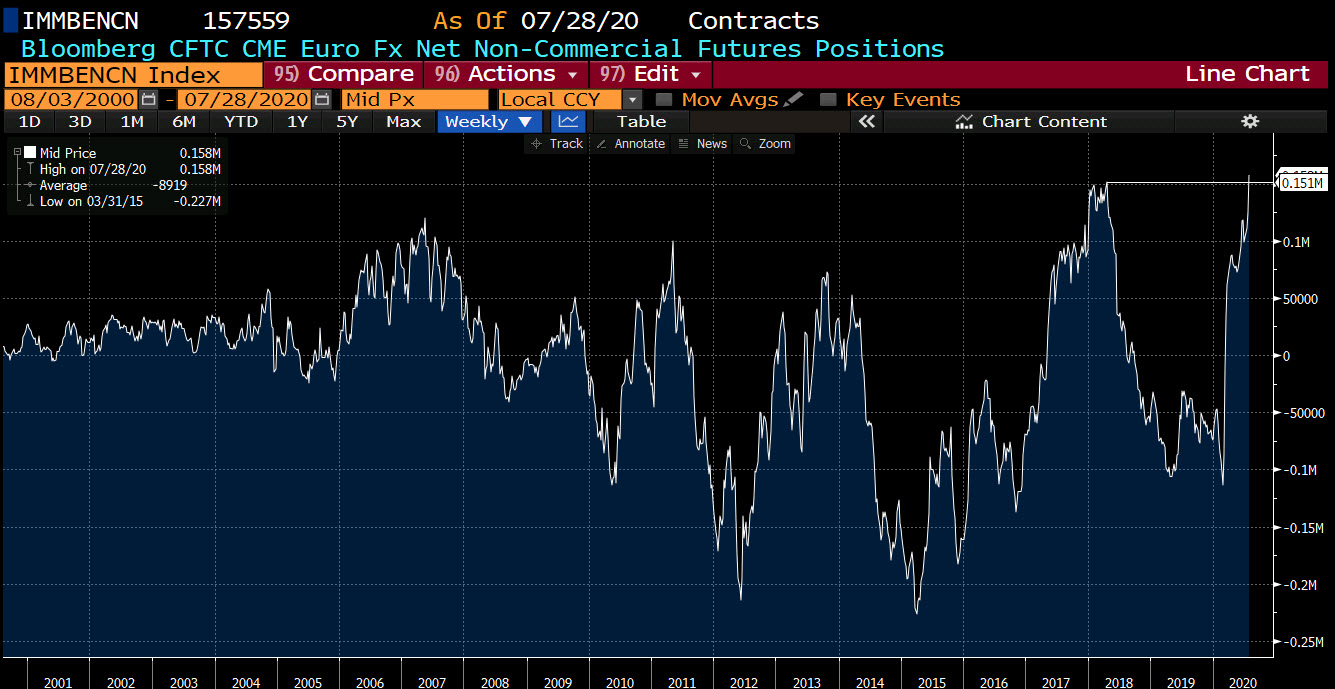

- EUR long 157K vs 125K long last week. Longs increased by 32K

- GBP short 25K vs 15K short last week. Shorts increased by 10K

- JPY long 29K vs 19K long last week. Longs increased by 10K

- CHF long 8K vs 7K long last week. Longs increase by 1K

- AUD short 5K vs 0K long last week. Shorts increased by 5K

- NZD short 1K vs 2K last week. NZD switches from long to short. 3K change

- CAD short 13k vs 17K short last week. Shorts trimmed by 4K

Highlights:

The BIG HIGHLIGHT for the week is in the EUR. The EUR longs spiked up by 32K to 157K in the current week to a record high for long positions. The move higher is corresponding to higher EURUSD prices. The price of the EURUSD has been up for 6 consecutive weeks. The long position started to move more to the upside during the May 19 week when the position was at 72K. The EURUSD during that week was down at 1.0800. The price high today reached to 1.1908 before backing off. Nice trade for the longs.

Of course, a concern for markets that get too long or short, is that there can be a squeeze the other way if prices start to lose trend momentum. As a result, be careful of too much of a good thing, but let the technicals tell the story. They have been bullish.

The GBP shorts, however, increased by 10K to 25K (still much lower than the EUR longs) while the currency has moved higher.

The JPY longs increased and the USDJPY moved down (higher JPY) into early trading today. However, the price snapped back higher and nearly erased the full move lower this week in a single day.