Dow, S&P, NASDAQ close higher for the 4th consecutive month

the month of July is over and all the major indices closed higher for the 4th consecutive month. The S&P index had its second-best July performance since 2010. Apple, Amazon, Facebook all of the way after their earnings release last night. Apple rose up 10.47%. Facebook rose 8.18% and Amazon rose by 3.7%. Alphabet was left out despite posting better earnings. Their stock fell by -3.28%.

On the downside the Dow post its 2nd straight weekly decline.

The final numbers are showing:

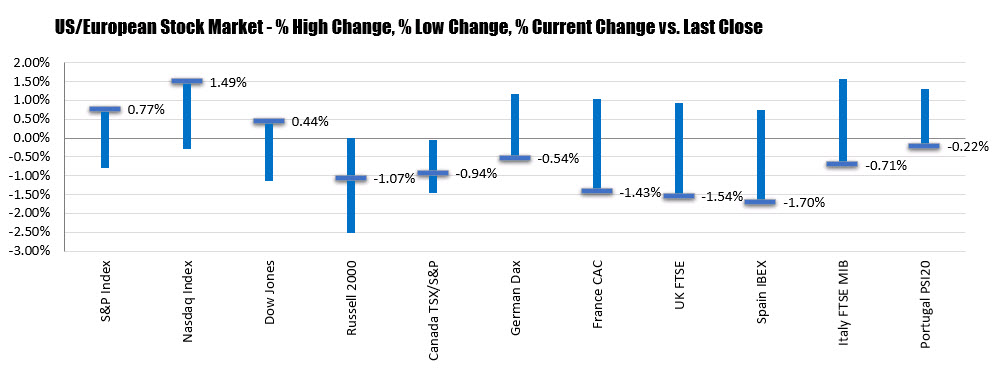

- S&P index up 24.9 points or 0.77% at 3271.12

- NASDAQ index up 157.46 points or 1.49% at 10745.23

- Dow industrial average up 114.67 points or 0.44% at 26428.33

For the week, the NASDAQ led the way. The Dow industrial average could not make it to the unchanged level falling by -0.16%:

- S&P index rose by 1.73%

- NASDAQ rose by 3.69%, and as mentioned

- Dow fell by -0.16%

For the month, the market initially tried to rotate out of the NASDAQ stocks and into the industrial/broader market, but the run up in tech stocks today and this week push the NASDAQ back into the lead:

- S&P index rose by 5.51%. As mentioned it was the 2nd largest July increase since 2010

- NASDAQ index rose by 6.82%

- Dow rose by 2.3%

For the year to date, the Nasdaq index continues to outperform, but the S&P index has moved back into the black (it dipped into the red earlier this week). The Dow remains lower on the year.

- S&P index up 1.25%

- Nasdaq up 19.76%

- Dow down -7.39%