Dollar’s broad based selloff continues in Asian session today. There are increasing concerns that momentum of US economic recovery is starting to falter. The pessimism is somewhat reflected in persistent decline in treasury yields too. Though, Canadian Dollar is even worse as pressured by sharp decline in oil prices. Euro and Sterling continue to stay strong across the board. Euro will be facing some tests from GDP data today today, but it will likely survive downside surprises.

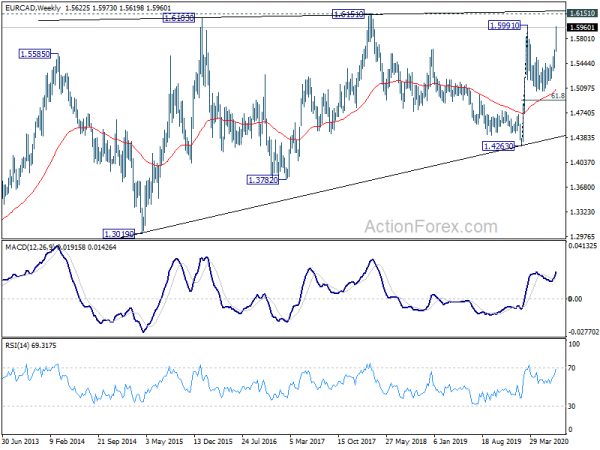

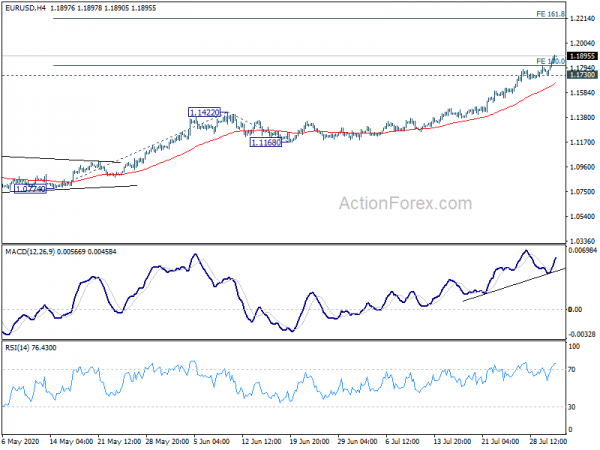

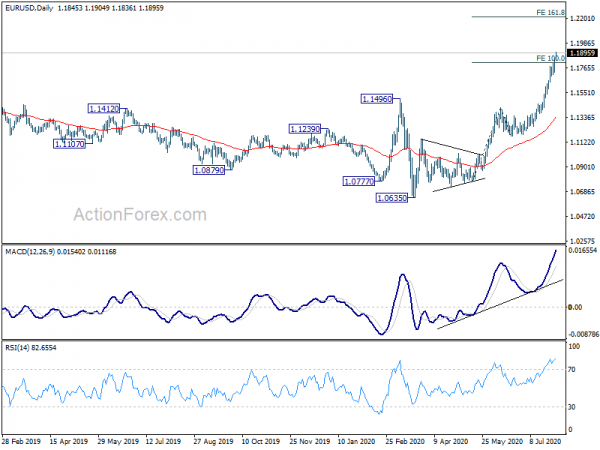

Technically, EUR/USD’s solid break of 1.1816 projection level suggests further upside acceleration. Next target will be 1.2216. EUR/CAD is on track to break through 1.5991 to resume near term rise from 1.4263. We’d be cautious on rejection by 1.6151 key resistance handle. But firm break there will be a key sign on medium term bullishness.

– advertisement –

In Asia, currently, Nikkei is down -2.28%. Hong Kong HSI is up 0.04%. China Shanghai SSE is down -0.02%. Singapore Strait Times is down -1.70%. Japan 10-year JGB yield is down -0.0088 at 0.011. Overnight, DOW dropped -0.85%. S&P 500 dropped -0.38%. NASDAQ rose 0.43%. 10-year yield dropped -0.038 to 0.541, broken April’s low at 0.543.

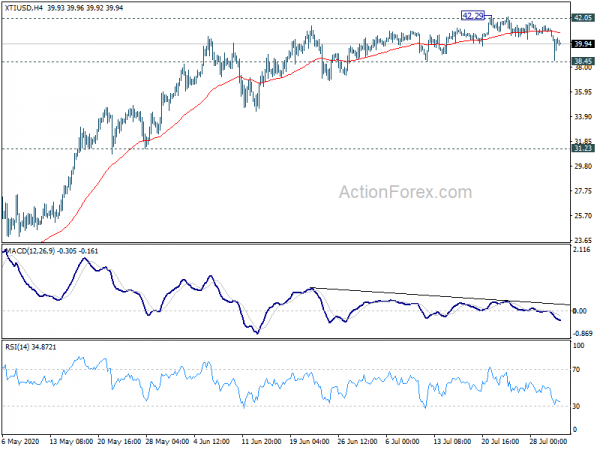

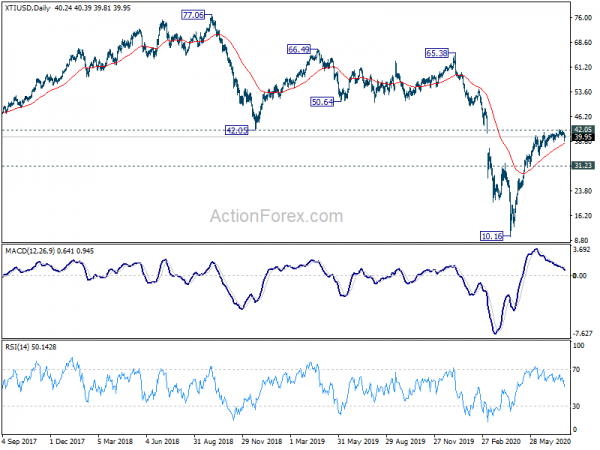

WTI crude oil defending 38.45 support for now, but looks vulnerable

WTI crude oil drops sharply to as low as 38.58 overnight, but recovery ahead of 38.45 support. Though there is no following buying for further recovery above 40 handle. 38.45 support now looks rather vulnerable. Sustained break of 38.45 should confirm rejection by 42.05 key resistance. Deeper fall should then be seen back towards structure support level at 31.23, to correct the rebound from April’s spike low.

Japan industrial production rose 2.7% in June, unemployment rate dropped to 2.8%

Japan industrial production rose 2.7% mom in June, above expectation of 1.2% mom. Annually, production dropped -17.7% yoy. Looking at some details, shipment rose 5.2% mom, inventories dropped -2.4% mom, inventory ratio dropped -7.0%. The data showed slight improvement after production hit its decade low in May. The METI also said manufacturers are expecting further rebound in production by 11.3% mom in July and 3.4% in August.

Also released, unemployment rate dropped to 2.8% in June, down from 3-year high of 2.9% in May, better than expectation of 3.1%. housing starts dropped -12.8% yoy in June, slightly worse than expectation of -12.6% yoy. Consumer confidence rose slightly to 29.4 in July, up from 28.4, missed expectation of 32.7.

China PMI manufacturing edged higher to 51.1

China’s official PMI Manufacturing rose to 51.1 in July, up from 50.9, slightly above expectation of 51.0. That’s the highest reading since March too. Looking at some details, production rose 0.1 to 54.0. New orders also improved by 0.3 to 51.7. New export orders rose notably by 5.8 to 48.4, but stayed in contraction. PMI Non-Manufacturing retreated mildly to 52.3, down from 54.4, but beat expectation of 51.2. Overall, the set of data suggests that recovery in on track, but it will remain a long road back to pre-pandemic levels.

Australia private sector credit dropped -0.2% in June

Australia private sector credit dropped -0.2% mom in June, wore than expectation of 0.2% mom. Housing credits rose 0.2% mom. But personal credits dropped -0.6% mom while business credits dropped even more by -0.8% mom. PPI dropped -1.2% qoq in Q2, much worse than expectation of 0.3% qoq. Annually, PPI turned negative to -0.4% yoy versus expectation of 1.3% yoy.

Looking ahead

The economic calendar is very busy today. Eurozone Q2 GDP will be a major focus, together with July CPI flash. France and Italy will also release Q2 GDP while Germany will release CPI. Swiss will release retail sales. Later in the day, Canada GDP will be a focus while RMPI and IPPI will be featured. US will release personal income and spending with PCE inflation, employment cost and Chicago PMI.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1770; (P) 1.1809; (R1) 1.1887; More…..

EUR/USD’s rally continues today and hits as high as 1.1904 so far. 100% projection of 1.0774 to 1.1422 from 1.1168 at 1.1816 is taken out firmly. Intraday bias stays on the upside for 161.8% projection at 1.2216 next. On the downside, break of 1.1730 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, the strong break of 1.1496 resistance now suggests that whole down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise form 1.0635 should be the third leg of the pattern from 1.0339 (2017 low). Further rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Jun | 2.80% | 3.10% | 2.90% | |

| 23:50 | JPY | Industrial Production M/M Jun P | 2.70% | 1.20% | -8.90% | |

| 01:00 | CNY | Manufacturing PMI Jul | 51.1 | 51.0 | 50.9 | |

| 01:00 | CNY | Non-Manufacturing PMI Jul | 54.2 | 51.2 | 54.4 | |

| 01:30 | AUD | Private Sector Credit M/M Jun | -0.20% | 0.20% | -0.10% | |

| 01:30 | AUD | PPI Q/Q Q2 | -1.20% | 0.30% | 0.20% | |

| 01:30 | AUD | PPI Y/Y Q2 | -0.40% | 1.30% | 1.30% | |

| 05:00 | JPY | Housing Starts Y/Y Jun | -12.8% | -12.60% | -12.30% | |

| 05:00 | JPY | Consumer Confidence Index Jul | 29.5 | 32.7 | 28.4 | |

| 05:30 | EUR | France GDP Q/Q Q2 P | -15.20% | -5.30% | ||

| 06:00 | EUR | Germany Retail Sales M/M Jun | -3.50% | 13.90% | ||

| 06:30 | CHF | Real Retail Sales Y/Y Jun | 3.90% | 6.60% | ||

| 06:45 | EUR | France CPI M/M Jul P | 0.00% | 0.10% | ||

| 06:45 | EUR | France CPI Y/Y Jul P | 0.20% | 0.20% | ||

| 08:00 | EUR | Italy GDP Q/Q Q2 P | -15.00% | -5.30% | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | -12.00% | -3.60% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Jul P | 0.20% | 0.30% | ||

| 09:00 | EUR | Eurozone CPI – Core Y/Y Jul P | 0.70% | 0.80% | ||

| 12:30 | CAD | GDP M/M May | 3.10% | -11.60% | ||

| 12:30 | CAD | Raw Material Price Index M/M Jun | 13.90% | 16.40% | ||

| 12:30 | CAD | Industrial Product Price M/M Jun | 0.10% | 1.20% | ||

| 12:30 | USD | Personal Income M/M Jun | -0.80% | -4.20% | ||

| 12:30 | USD | Personal Spending Jun | 5.00% | 8.20% | ||

| 12:30 | USD | PCE Price Index M/M Jun | 0.00% | 0.10% | ||

| 12:30 | USD | PCE Price Index Y/Y Jun | 0.50% | 0.50% | ||

| 12:30 | USD | Core PCE Price Index M/M Jun | 0.20% | 0.10% | ||

| 12:30 | USD | Core PCE Price Index Y/Y Jun | 1.00% | 1.00% | ||

| 12:30 | USD | Employment Cost Index Q2 | 0.60% | 0.80% | ||

| 13:45 | USD | Chicago PMI Jul | 43 | 36.6 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Jul F | 72.8 | 73.2 |