Sterling surges broadly in rather mixed markets today. Rebound in cross against Euro is seen as a major reason for the Pound’s strength. Australian Dollar is following as the second strongest for now, partly listed by cross buying against New Zealand Dollar. Kiwi and Swiss Franc are, on the other hand, the weakest. At this point, Dollar is still generally soft as focus turns to FOMC rate decision. As noted before, we’re not expecting anything spectacular in today’s announcements. Dollar could resume prior selloff after this event risk.

Technically, GBP/JPY recovers notably after drawing support from 4 hour 55 EMA. Focus is back on 136.62 temporary top and break will resume the choppy rise from 131.68. EUR/JPY is also drawing support from 4 hour 55 EMA at the time of writing. Strong rebound from current level will put focus back to 124.43 resistance and break will resume larger rise. Regaining strength in GBP/JPY and EUR/JPY could help push Yen lower. But USD/JPY needs to break 105.68 minor resistance to signal its following other Yen crosses higher.

In Europe, currently, FTSE is up 0.21%. DAX is down -0.12%. CAC is up 0.68%. German 10-year yield is up 0.0041 at -0.503. Earlier in Asia, Nikkei dropped -1.15%. Hong Kong HSI rose 0.45%. China Shanghai SSE rose 2.06%. Singapore Strait Times dropped -0.37%. Japan 10-year JGB yield dropped -0.0050 to 0.021.

– advertisement –

US goods exports and imports rose in June, trade deficit narrowed to $70.6B

US exports of goods rose 13.9% mom to USD 102.6B in June. Imports of goods rose 4.8% mom to USD 173.2B. Trade deficit narrowed -6.1% mom to USD 70.6B. smaller than expectation of USD -75.5B.

Whole sales inventories dropped -2.0% mom to USD 629.6B, worse than expectation of -0.4% mom.

Fed to hold its cards until September

FOMC rate decision is a major focus today but there is little expectation on anything dramatic there. Fed funds rate will be held at 0.00-0.25%. The unlimited asset purchase program will continue at a pace of USD 80B for treasuries and USD 40B for MBS. There might be change to forward guidance though, to tie future rate hike to employment and inflation. But the big changes will be held until September.

By September meeting, Fed should have completed the policy framework review. Congress should have passed any additional fiscal stimulus. More information will be obtained regarding the economy, in particular with second wave of coronavirus infections in effect. Updated economic projections will also be completed.

Some suggested readings on FOMC:

BoE Haldane: Two roundtables underline very different lived experience facing people

BoE chief economist Andy Haldane said the mood at the two virtual roundtables with North east businesses and organizations “could not have been more different, underlining the very different lived experience facing people.”

On the one hand, he had “surprisingly – and encouragingly – upbeat discussion with representatives from the housing industry, from the private and social sectors and some local mortgage lenders”. But his optimism was “tempered” at the roundtable with charity sector and community leaders. There’s been a “huge hit” to the financial health of charities, and their finances are being “stretched.”

Released from UK, mortgage approvals jumped to 40k in June, beat expectation of 35k. M4 money supply rose 1.0% mom, below expectation of 2.2% mom.

From Swiss, Credit Suisse economic expectations dropped to 42.4 in July, down from 48.7, but beat expectation of 39.4.

Fitch downgrade Japan’s rating outlook to negative, expects no rate cut by BoJ

Fitch affirmed Japan’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at “A”, but downgraded the outlook to negative from stable. The rating agency said: “The coronavirus pandemic has caused a sharp economic contraction in Japan, despite the country’s early success in containing the virus… The Negative Outlook reflects that the higher debt ratio and downside risks to the macroeconomic outlook will nevertheless exacerbate the challenge of placing the debt ratio on a downward path over the medium term.”

Fitch also projects the economy to contract by -5% in 2020, before rebounding to 3.2% growth in 2021 “due partly to the low base effect”. GDP would not recover to pre-pandemic level until 4Q21. The gross general government debt ratio will rise by 26% in 2020 to around 259% of GDP and stabilize just above 260% in 2021-22. General government deficit would surge to 14.3% of GDP in 2020, up from 3.1% in 2019, then drop back to 10.9% in 2021 and 5.3% in 2022.

The rating agency also expects BoJ to maintain current interest-rate setting through “at least the end of 2022” under the YCC framework. It expects BoJ to “refrain from” cutting interest rate further because of the impact on “bank profitability”. Rather, “an extension of temporary quantitative easing programmes beyond their expiry in March 2021 or refinements to its forward guidance remain more likely.” Fitch also projects headline CPI of -0.6% at the end of 2020 and turns marginally positive in 2021.

Australia CPI dropped -1.9% qoq in Q2, biggest fall in 72 year of history

Australia CPI plunged -1.9% qoq in Q2, slightly above expectation of -2.0% qoq. That’s still the largest quarterly fall in the 72 year history of the data. Annually, CPI turned negative to -0.3% yoy, down from Q1’s 2.2% yoy. It’s only the third time annual inflation turned negative since 1949. The previous times were in 1962 and 1997-98.”

Nevertheless, the quarterly decline was mainly the result of free child care (-95%), a significant fall in fuel price (-19.3%) and a fall in pre-school and primary education (-16.2%). Excluding these three components, the CPI would have risen 0.1% qoq in Q2.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2862; (P) 1.2907; (R1) 1.2977; More….

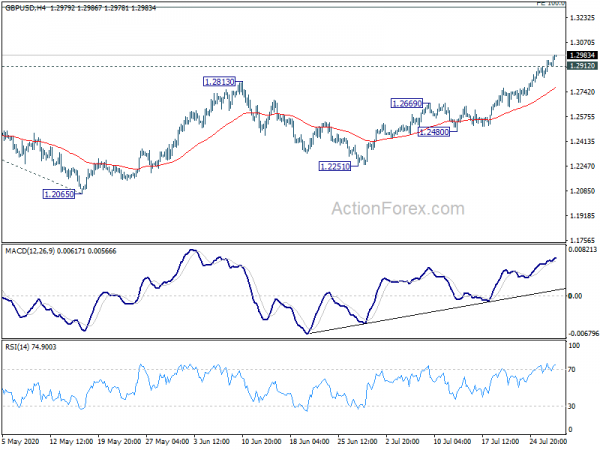

GBP/USD’s rally extends to as high as 1.2986 so far today and intraday bias remains on the upside. Current rise from 1.1409 should target 100% projection of 1.1409 to 1.2647 from 1.2065 at 1.3303 next. On the downside, below 1.2912 minor support will turn intraday bias neutral first. But retreat should be contained well above 1.2669 resistance turned support to bring another rally.

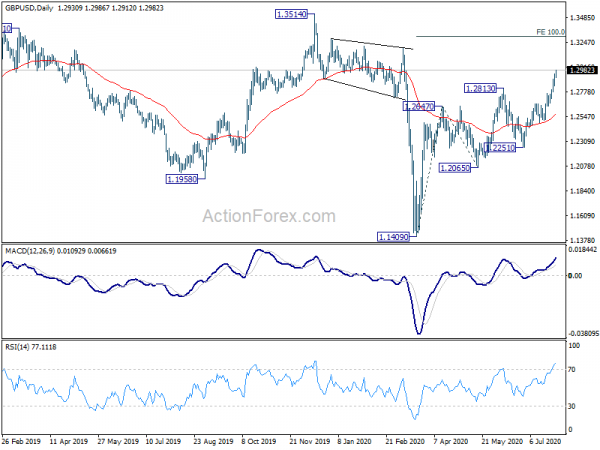

In the bigger picture, while the rebound from 1.1409 is strong, there is not enough evidence for trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. However, decisive break of 1.3514 should at least confirm medium term bottoming and turn outlook bullish for 1.4376 resistance first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Jun | -1.30% | -1.60% | ||

| 01:30 | AUD | CPI Q/Q Q2 | -1.90% | -2.00% | 0.30% | |

| 01:30 | AUD | CPI Y/Y Q2 | -0.30% | -0.40% | 2.20% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Q/Q Q2 | -0.10% | 0.10% | 0.50% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Y/Y Q2 | 1.20% | 1.40% | 1.80% | |

| 08:00 | CHF | Credit Suisse Economic Expectations Jul | 42.4 | 39.4 | 48.7 | |

| 08:30 | GBP | Mortgage Approvals Jun | 40K | 35K | 9K | |

| 08:30 | GBP | M4 Money Supply M/M Jun | 1.00% | 2.20% | 2.00% | 2.10% |

| 12:30 | USD | Wholesale Inventories Jun P | -2.00% | -0.40% | -1.20% | |

| 12:30 | USD | Goods Trade Balance (USD) Jun | -70.6B | -75.5B | -74.3B | |

| 14:00 | USD | Pending Home Sales M/M Jun | 15.60% | 44.30% | ||

| 14:30 | USD | Crude Oil Inventories | 1.0M | 4.9M | ||

| 18:00 | USD | FOMC Rate Decision | 0.25% | 0.25% | ||

| 18:30 | USD | FOMC Press Conference |

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)