The USD is rebounding modestly today

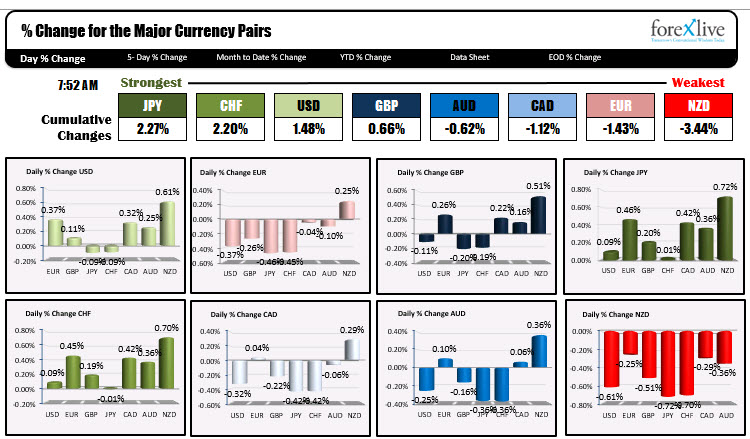

As North American traders enter for the day, the JPY is the strongest, the NZD is the weakest. The USD is rebounding modestly after trading to the lowest level since June 2018 yesterday. As mentioned the gain is still modest. Because the dollar is up, we are also seeing a fall in the price of gold and silver today. Stocks in premarket trading are lower and yields are modestly lower as well. The Senate released their plan which including cutting the emergency benefit to $200 per week from $600 per week, and proposed $1200 for qualifying Americans. They will have another PPP program and provide funding to schools to encourage opening.

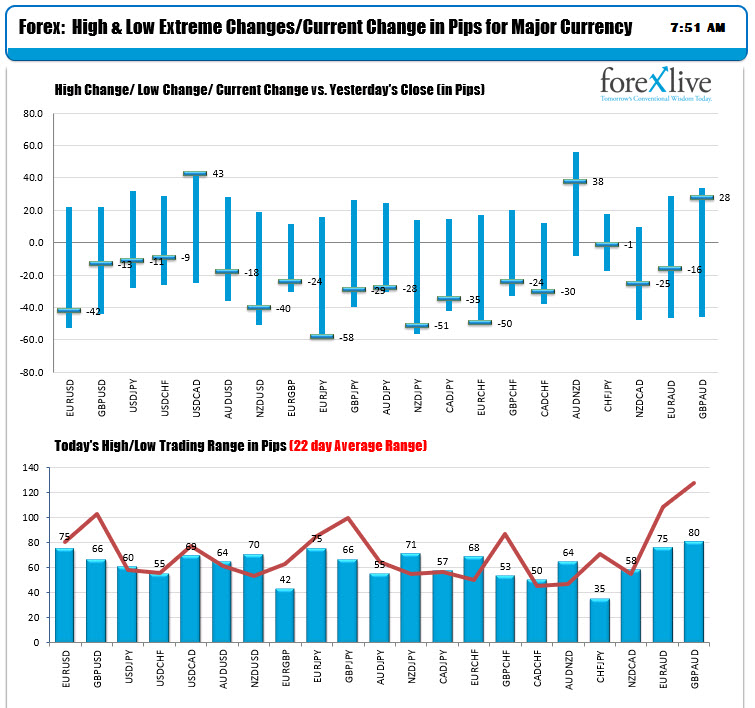

The ranges and changes for the pairs have seen decent ranges again today, with price action up and down. For the USD, the major pairs are showing mixed signals. The dolllar is higher vs teh EUR (down -42 pips) and USDCAD (up 40 pip),but is still weaker vs the JPY and CHF as they see flows into the safety of those currencies (down -13 and -11 pips).

In other markets

- Spot gold is trading down $-13.18 or -0.68% of $1929. Silver today is trading down over $1.09 or 4.45% at $23.50 as it loses some of its shine after the 7% gain yesterday

- WTI crude oil futures are trading down $0.13 or -0.3% $41.47

In the premarket for US stocks the major indices are trading lower after each of the indices close higher yesterday (S&P up 23.70 points, NASDAQ up 173 points, Dow industrial average up 114.88 points):

- Dow is down down -121 points

- S&P index is down -11.41 points

- NASDAQ index is down -40.6 points

In the European equity markets the major indices also lower (the Spain Ibex is the exception with a modest gain currently):

- German DAX, -0.41%

- France’s CAC, -0.74%

- UK’s FTSE 100, -0.11%

- Spain’s Ibex, +0.15%

- Italy’s FTSE MIB, -1.45%

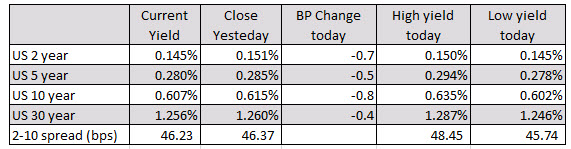

In the US debt market yields are down marginally. The 2 – 10 year spread is near unchanged levels

In the European debt market, the benchmark 10 year yields are mixed with Germany, France marginally lower. Yields in the UK, Spain, Italy and Portugal and Italy are marginally higher.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending