The USD is lower again (Gold at a record) as the new week begins

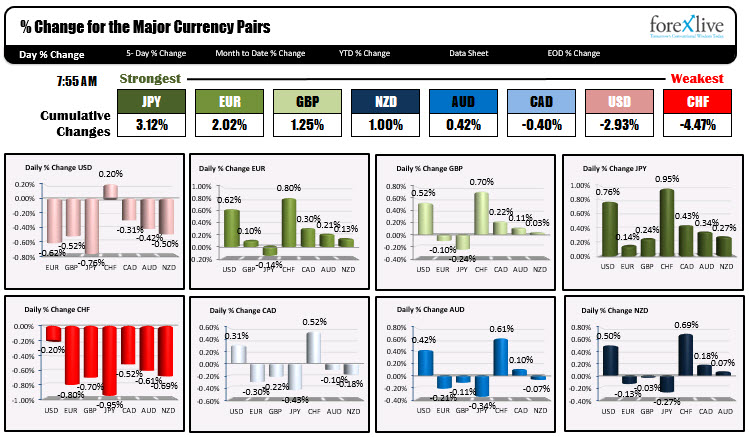

The JPY is the strongest and continues it’s trend higher (USDJPY lower) and the CHF is the weakest (rebounding from its downward trend) as NA traders enter for the day (and start the week). The USD is lower once again with gains only vs the CHF today. The lower dollar has the price of gold and silver moving to the upside. Spot gold is trading a a record level taking out the September 2011 high at $1921.17. The markets are hopeful that the 4th coronavirus stimulus measures will be enacted shortly. The expectations are for a sinless check of $1200, a moratorium on evictions, some relief in the form of emergency employment payments although they will be less than the $600 per week currently.

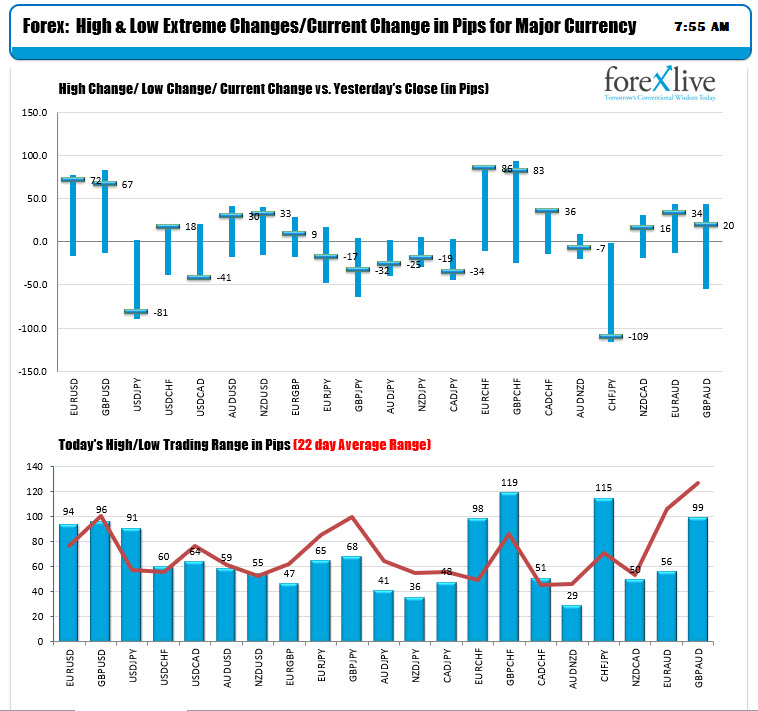

Looking at the ranges and changes the major pairs vs. US dollar are all trading near the 22 day average or above. Good activity in the currencies as the dollar trends to the downside (with the exception of the USDCHF).

In other markets

- Spot gold is trading up $34.40 or 1.81% at $1936.30. The new all-time record high was reached earlier at $1945.26. Spot silver is also racing higher. It is up $1.44 or 6.35% at $24.22

- WTI crude oil futures are trading up $0.37 or 0.9% at $41.61

In the premarket for US stocks the major indices are trading higher:

- Dow is down up 82 points

- S&P index is up 13 points

- NASDAQ index is up 86 points

in the European equity markets the major indices also lower:

- German DAX, +0.33%

- France’s CAC, -0.13%

- UK’s FTSE 100, -0.14%

- Spain’s Ibex, -1.53%

- Italy’s FTSE MIB, -0.37%

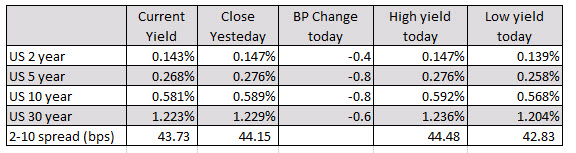

In the US debt market yields are down marginally. The yield curve is pretty flat compared to Friday’s close.

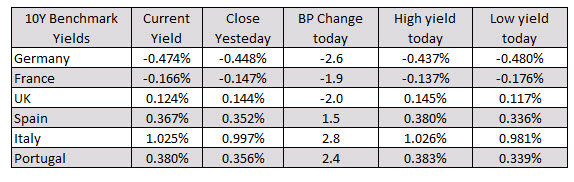

In the European debt market, the benchmark 10 year yields are mixed with Germany, lower. France and UK. Investors are shunning Spain, Italy and Portugal .

breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)