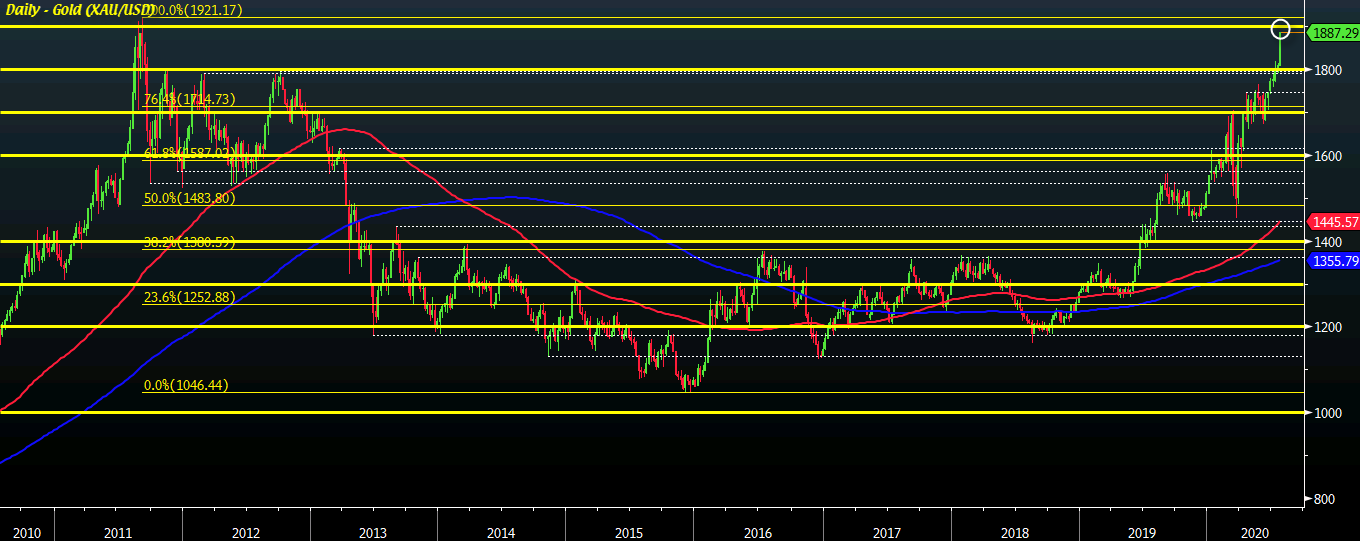

Gold posts fresh highs on the session, trades at its highest levels since 2011

The run higher in gold and silver this week has been quite stunning with gold rising for a fifth straight day in somewhat of a parabolic move from $1,800 to now move within touching distance of the $1,900 level.

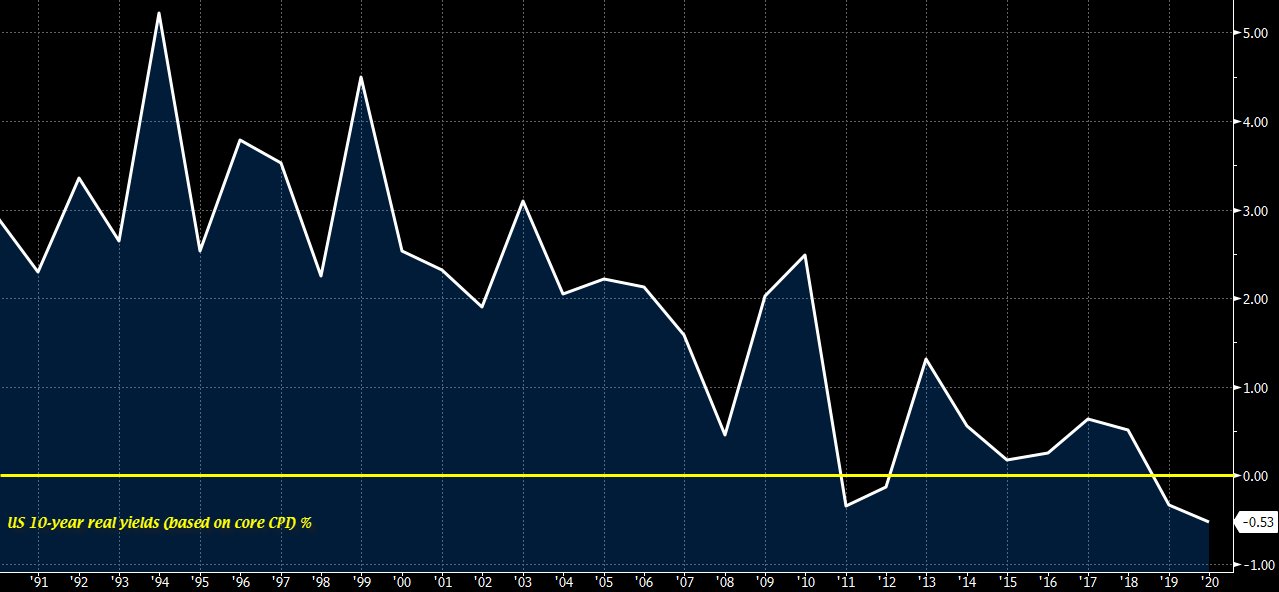

The reasoning for gold gains have been laid out for all to see since the start of the pandemic, with central banks set to adopt the current set of easing measures for many more years to come and real yields in most countries are turning zero or negative.

The US is a good example of the latter scenario:

Gold getting a tailwind from a higher proportion of negative-yielding debt was a story that began last year, but the coronavirus crisis pretty much just accelerated all of that.

Back to the charts, it is tough to fight the momentum in gold as it approaches $1,900 and the 2011 high of $1,921. But as we all know, nothing in the market moves in a straight line and the sharp move this week could easily be met with a violent pullback as well.

I expected more of a stall around $1,800 levels for gold but buyers have been incessantly stepping in on every dip last week and here we are now.

The dollar side of the equation also presents a compelling case for gold to keep gaining, should the greenback keep faltering amid a push higher in risk – as convoluted as it may sound, that is also a supportive factor for gold at this point in time.

But as mentioned before, profit-taking activity around these levels would not surprise me and I’d be more comfortable on building further positions on dips for now.

Looking ahead, watch out for the 2011 high @ $1,921 as that may trigger another round of stops as we will see fresh record highs in gold past that. It will eventually come, but just be wary of being too hasty i.e. moving too far, too fast.

breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending