Euro’s rally continues today as, despite some jitters, it appears that EU would agree on a compromised deal of recovery fund. It’s reported that after marathon negotiations, the Netherlands, Austria, Denmark and Sweden are satisfied with EUR 390B fund being made available as grants with the rest coming as low-interest loans. EU leaders are still in talks finalizing the deal and the tones sound optimistic. Euro is so far the strongest one today, while Yen is the weakest, as weighed down mildly by poor exports data.

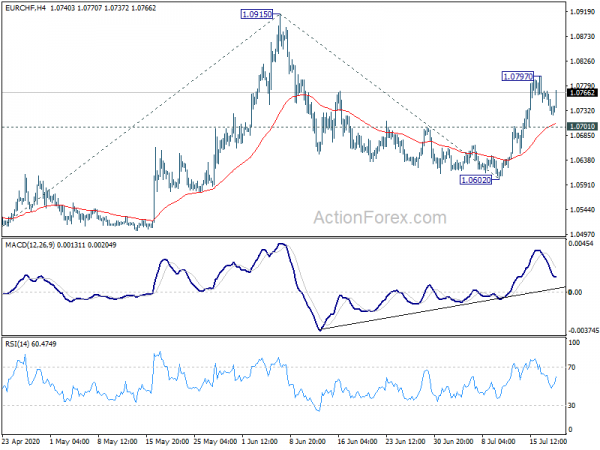

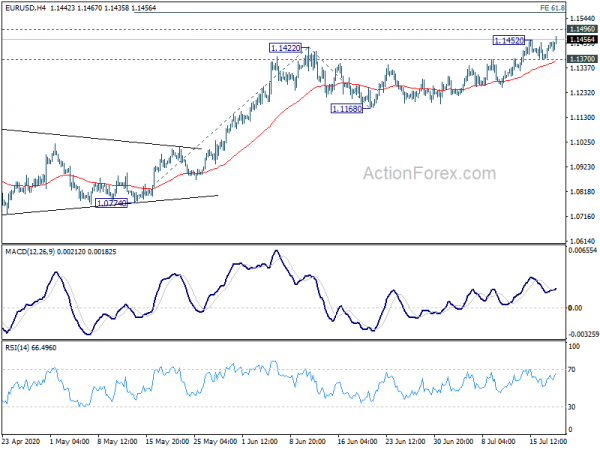

Technically, EUR/USD breaks through last week’s high of 1.1452 and it’s now heading to 1.1496 key resistance. Sustained break there would confirm underlying medium term bullishness, but we’ll stay cautious on a rejection. EUR/JPY’s choppy rebound from 119.31 is showing some upside acceleration for retesting 124.43 short term top too. A focus will now be on EUR/CHF, which rebounds well ahead of 1.0701 minor support. Break of 1.0797 resistance will solidify near term bullishness for retesting 1.0915 short term top too.

– advertisement –

In Asia, Nikkei closed up by 0.09%. Hong Kong HSI is up 0.13%. China Shanghai SSE is staging a strong rebound after last week’s steep pull back, up 2.88%. Singapore Strait Times is down -0.37%. Japan 10-year JGB yield is up 0.0057 at 0.023.

Japan exports dropped -26.2% yoy in June, exports to US dropped -46.6%

In non-seasonally adjusted terms, Japan’s exports slumped -26.2% yoy to JPY 4.86T in June. Imports dropped -14.4% yoy to JPY 5.13T. Trade deficit came in at JPY -269B. In seasonally adjusted terms, exports rose 1.4% mom in June while exports dropped -1.8% mom. Trade deficit narrowed to JPY -424B from May’s JPY 585B.

Looking at some details, exports to US dropped -46.6% yoy. Exports to EU dropped -28.4% yoy. Exports to China, though, was largely unchanged and dropped only -0.2% yoy.

The set of data suggests that exports would remain weak in Q3, as coronavirus pandemic carries on. Weak external demand could drag the Japanese economy into a more prolonged and deeper recession. BoJ Governor Haruhiko Kuroda said last week that the economic would continue to improve gradually in H2. But as he said, risks are clearly skewed to the downside for the export-led economy.

New Zealand sets aside NZD 15B of pandemic fund for future use

New Zealand Finance Minister Grant Robertson said today that the country’s economy is “doing better than expected and is more open than anywhere else in the world”. Yet, “as we look around the world, it is clear that this global pandemic is continuing to grow.” In the face of ongoing uncertainty, “now is the time to be cautious and keep our powder dry.”

Robertson announced to set aside the remaining NZD 15B of the NZD 50B Covid-19 Response and Recovery Fund, with no plans to spend it ahead of the election. “We are setting aside a significant sum of money to be used as needed in the future,” he added.”This is the fiscally and socially responsible thing to do.”

“We are doing everything we can to keep Covid-19 at our border – nobody wants a second wave. The responsible course of action is to make sure we are prepared for the worst – to give confidence to New Zealanders that we will be able to continue to act swiftly and decisively in our ongoing fight against this virus,” Robertson said.

PMIs from Japan, Australia, EU, UK and US watched

The economic calendar is relatively light in the week ahead. PMIs from Japan, Australia, Eurozone, UK and US will provide more hints on how well these economies are recovering out of the pandemic. Additionally, RBA minutes and Australia retail sales, Canada retail sales and CPI, and New Zealand trade balance will also be watched too.

Here are some highlights for the week:

- Monday: Japan trade balance, BoJ minutes; Germany PPI; Eurozone current account.

- Tuesday: RBA minutes; Swiss trade balance, UK public sector net borrowing; Canada retail sales, new housing price index.

- Wednesday: Japan PMI manufacturing; Australia retail sales; Canada CPI; US house price index, existing home sales.

- Thursday: Australia NAB business confidence; Germany Gfk consumer sentiment; UK CBI industrial order expectations; US jobless claims, leading index.

- Friday: New Zealand trade balance; Australian PMIs; UK Gfk consumer confidence, retail sales, PMIs; Eurozone PMIs; US PMIs, new home sales.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1388; (P) 1.1416; (R1) 1.1454; More….

EUR/USD’s rally resumes after brief consolidations and reaches as high as 1.1467 so far. Intraday bias is back on the upside for 1.1496 key resistance. Firm break there will carry larger bullish implications and target 61.8% projection of 1.0774 to 1.1422 from 1.1168 at 1.1568 next. On the downside, break of 1.1370 minor support will turn bias back to the downside for 1.1168 support. Decisive break there will indicate near term bearish reversal.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Jun | -0.42T | -0.33T | -0.60T | -0.59T |

| 23:50 | JPY | BoJ Minutes | ||||

| 6:00 | EUR | Germany PPI M/M Jun | 0.00% | 0.20% | -0.40% | |

| 6:00 | EUR | Germany PPI Y/Y Jun | -1.80% | -1.50% | -2.20% | |

| 8:00 | EUR | Eurozone Current Account (EUR) May | 15.2B | 14.4B |