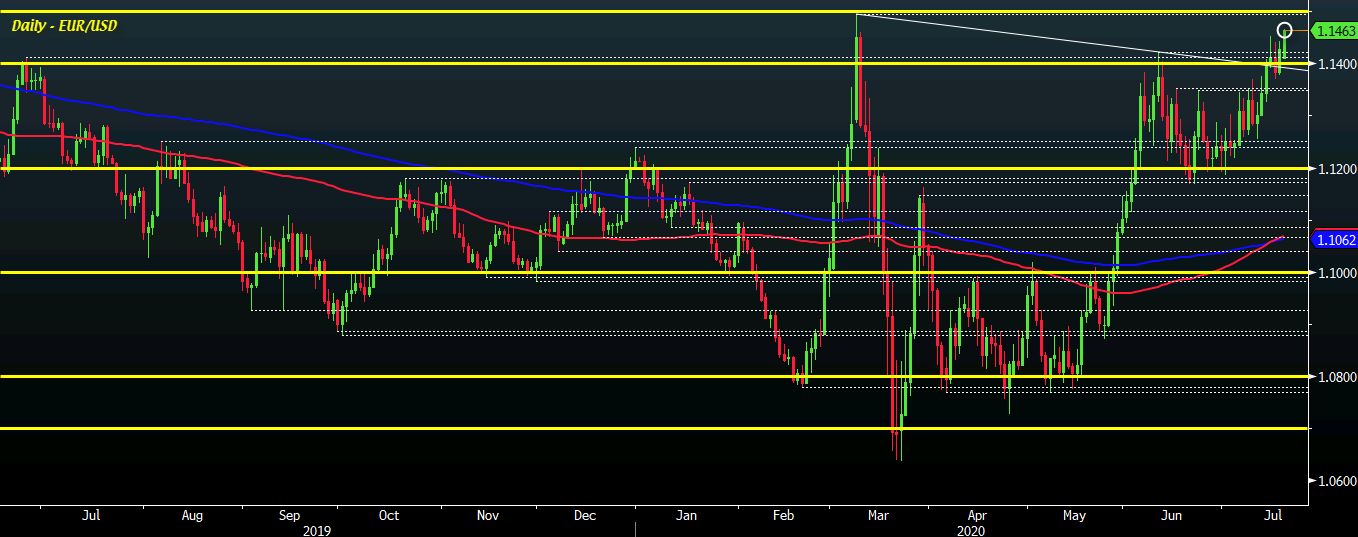

EUR/USD touches a high of 1.1467, its highest level since 9 March

The news from earlier (

Euro buyers are banking on a firm compromise on the recovery fund, but they need to do more to try and crack key resistance around 1.1495-00 to extend the momentum further.

That will be the key level to watch in the sessions ahead if the euro is to chase any material break to the upside based on the news we are seeing.

The thing to watch out for though is a potential “buy the rumour, sell the fact” play.

Euro long positions have continued to build over the past few weeks and with price action approaching a key resistance level i.e. 1.1495-00, there is good reason for buyers to take profits amid having already priced in the optimism on the news above.

A compromise between European leaders is certainly positive and bodes well for the recovery, but the fact that it may still not be so straightforward with plenty of details yet to be ironed out may give reason for euro buyers to take a breather in the aftermath.

The knee-jerk reaction is no doubt positive, but what comes after depends on the conviction of EUR/USD to break back above 1.1495-00 in my view.

Failure to do so could keep euro gains at bay for the time being with any drop back under the 100-hour moving average @ 1.1405 to prove as a major setback for buyers.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending