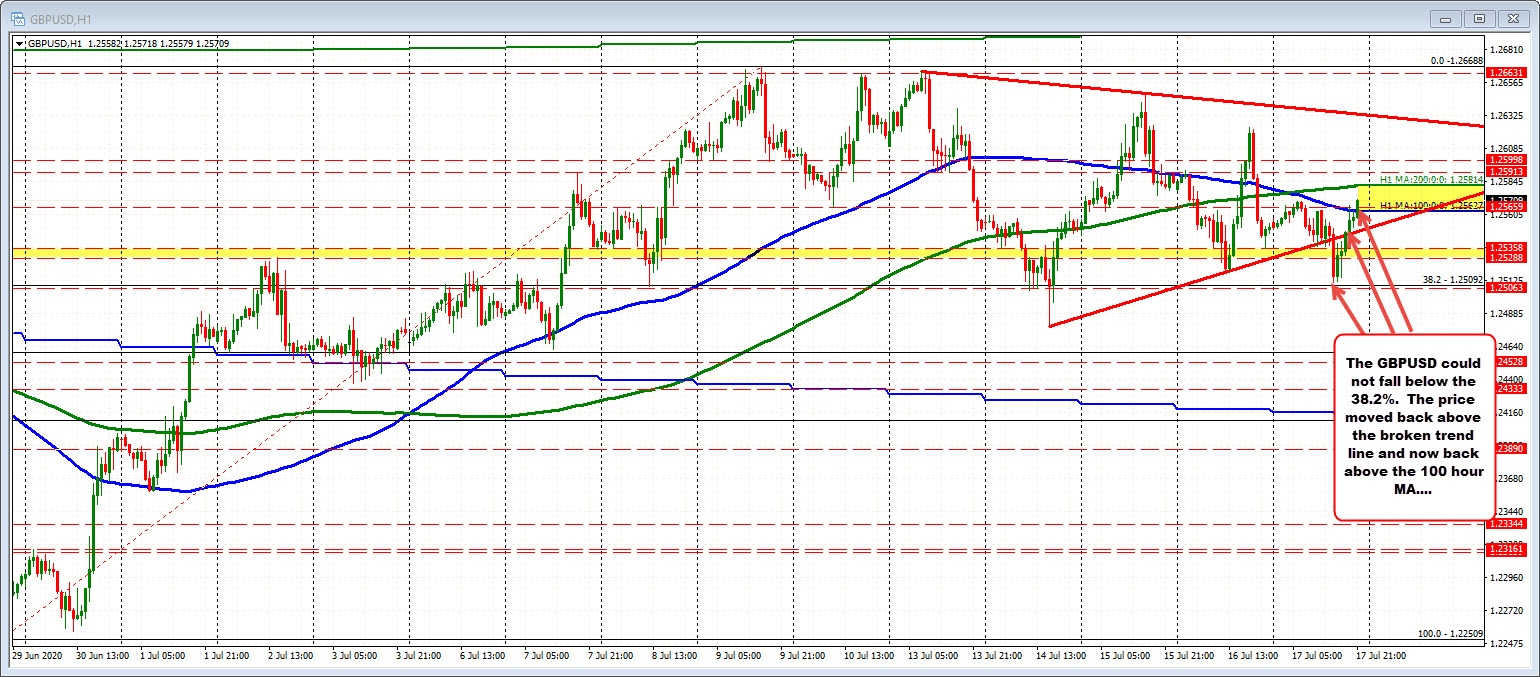

The low today could not fall below the 38.2% retracement

The GBPUSD bottomed in the NY session just above the 38.2% at 1.2509. In an earlier post, I outlined how the pair needed to get back below that MA level and stay below. It could not. The sellers turned back to buyers.

The price has now moved back above the swing area at 1.25288 and 1.25358 and then the underside of the broken trend line at 1.2545.

With the additional move back above the 100 hour MA, the pair has placed itself near the middle of the trading range for the week (at 1.2572), and between both the 100 hour MA and the 200 hour MA (above at 1.25814).

The break outside the range for the week will need to be saved for next week. Today’s attempt to get below the 38.2% could not muster enough momentum to make the break. As a result, we will have a clean slate for next week and traders can make the break for it.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)