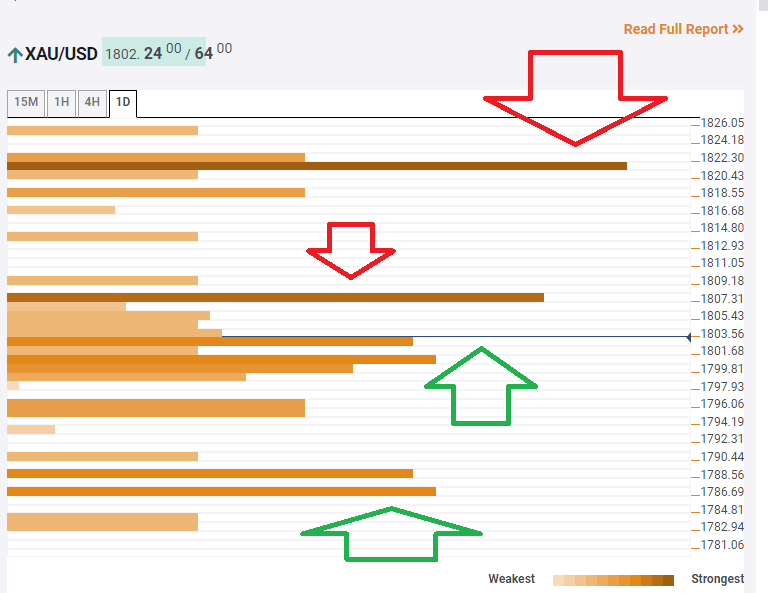

Gold Price Analysis: First hurdle crossed, next bullish levels in sight – Confluence Detector

Gold has recaptured the round $1,800 level and also topped a critical hurdle mentioned earlier in the day. The road is now open for XAU.USD to continue to higher ground.

The Technical Confluences Indicator is showing that the next target is at $1,807, which is the convergence of the Fibonacci 61.8% one-day, the Bollinger Band 1h-Upper, the Fibonacci 23.6% one-week, and more. Read more…

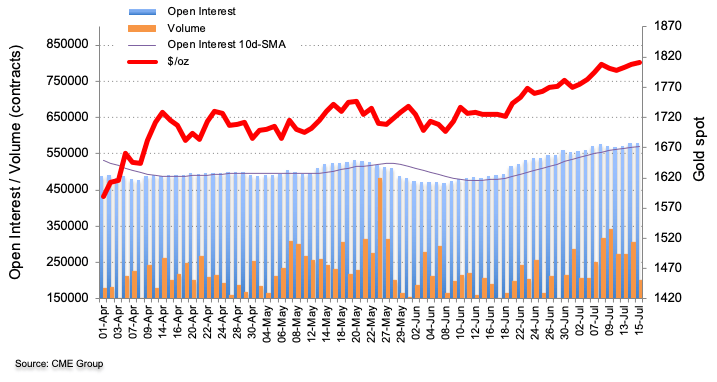

Gold Futures: Further losses are likely near-term

Open interest and volume in Gold futures markets increased by just 476 contracts and by around 19.5K contracts, respectively, on Thursday according to preliminary figures from CME Group.

Gold sees interim support near $1,740/oz

Thursday’s price action in Gold was in tandem with rising open interest and volume. That said, the ounce troy of the precious metal closed below the key $1,800 barrier on Thursday and the corrective decline could extend to the 55-day SMA, today at $1,742. Read more…

Gold steadily climbs back to $1800 mark

Gold edged higher through the early European session and steadily climbed back to the $1800 mark, recovering a part of the previous day’s losses.

Concerns about the ever-increasing coronavirus cases and worsening US-China relations underpinned the precious metal’s perceived safe-haven demand. This coupled with a subdued US dollar price action extended some additional support to the dollar-denominated commodity. Read more…