Forex news for NY trading on July 17, 2020

In other markets:

- Spot gold is closing the week above the $1800 in what was an up and down week for the precious metal. The high for the week was on Wednesday at $1814.90. The low for the week was on Tueday at $1790.79. The price is currently trading at $1809.64. The high reached $1812.03. The low extended to $1795.96 today.

- WTI crude oill is trading down $0.16 or -0.39% at $40.59. The hi reached $40.90. The low extended to $40.02. For the week the high price extended to $41.26. That was just one penny above the 50% retracement of the move down from the January 2020 high at $41.25

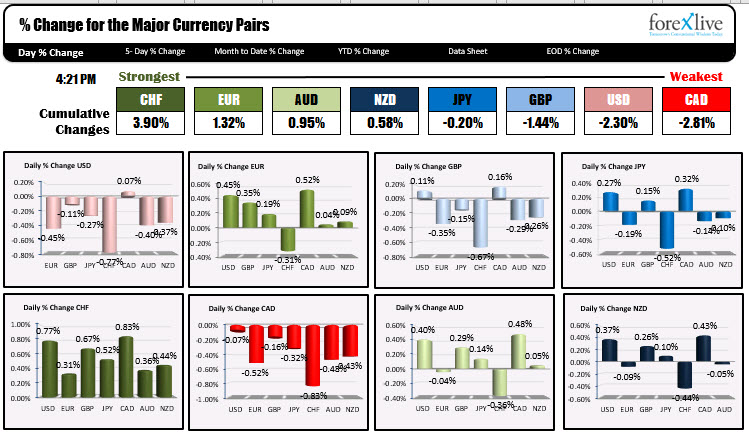

In the forex market today, the USDCHF trended to the downside and the CHF is ending the day as the strongest of the major currencies. The USDCHF had a trading range 79 pips which was all over the 22 day average of 58 pips . The CAD and USD are fighting for the strongest of the majors.

Overall the trading in the markets today was summer-like. Housing starts and building permits were higher than the previous month but a little lesson expectations. The University of Michigan consumer confidence for July was much worse than expected at 73.2 vs. 79.0 the current conditions were also lower than expectations at 84.2 vs. 86.8. As the ebbs and flows of the coronavirus continue, we can expect volatility in consumer sentiment as well.

Evidence of a more lackluster market were the modest gains and losses in the major stock indices. Each of the major indices close with gains or losses less than 0.3%. The S&P and NASDAQ index higher by 0.28%, while the Dow industrial average is now: forward to consecutive days with a -0.23% decline on the day.

The US debt market also traded in a narrow trading ranges not far from closing levels from yesterday:

- 2 year yield 0.141%, -0.3 basis points

- 5 year yield 0.277%, +0.1 basis point

- 10 year 0.621%, +0.4 basis points

- 30 year 1.325%, +1.7 basis points

A look at some currency pairs:

- EURUSD: The EURUSD is closing the week near the session highs. The high price for the week was reached on Wednesday at 1.14512. The current price is trading at 1.1436. Although the price dipped below the 100 bar moving average both yesterday and today, it was only by a few pips, before basing against the level and shooting higher. The 100 hour moving average currently comes in at 1.13959. In the new trading next week that moving average will be a barometer for both the bulls and the bears. Stay above is more bullish. Move below is more bearish.

- GBPUSD: The GBPUSD is end the week near the midpoint of the week at 1.2572. It is also closing between its 100 hour moving average at 1.2562 and 200 hour moving average at 1.2582. In the early trading next week, the traders will be watching which way the pair runs - does it go above the higher 200 hour moving average, or move back below the 100 hour moving average?

- USDJPY: The USDJPY is another 1 of the pairs that moved up and down in trading this week and is closing near the week’s midpoint . The midpoint of the week comes in at 107.04. The price is currently trading at 106.98. The range for the week was narrow with a high on Tuesday at 107.419 and a low on Wednesday at 106.661. Technically the bias is a little more to the downside with the price below the 50% retracement and also below its 100 hour moving average at 107.129 and 200 hour moving average at 107.167. It will take a move above each of those levels to swing the bias more to the upside in the new trading week

- USDCAD: Although the CAD was the weakest of the major currencies, it battled the USD for that distinction. As a result, the range for that pair was only 24 pips. It also traded above and below its 100 and 200 hour moving averages which are near converged at 1.3571. Those moving averages will be the barometer for the bulls and bears in early trading next week. Swing more to the upside would be more bullish. Swing more to the downside would be more bearish.

Wishing all a safe and healthy weekend. Thank you for your support of Forexlive.com