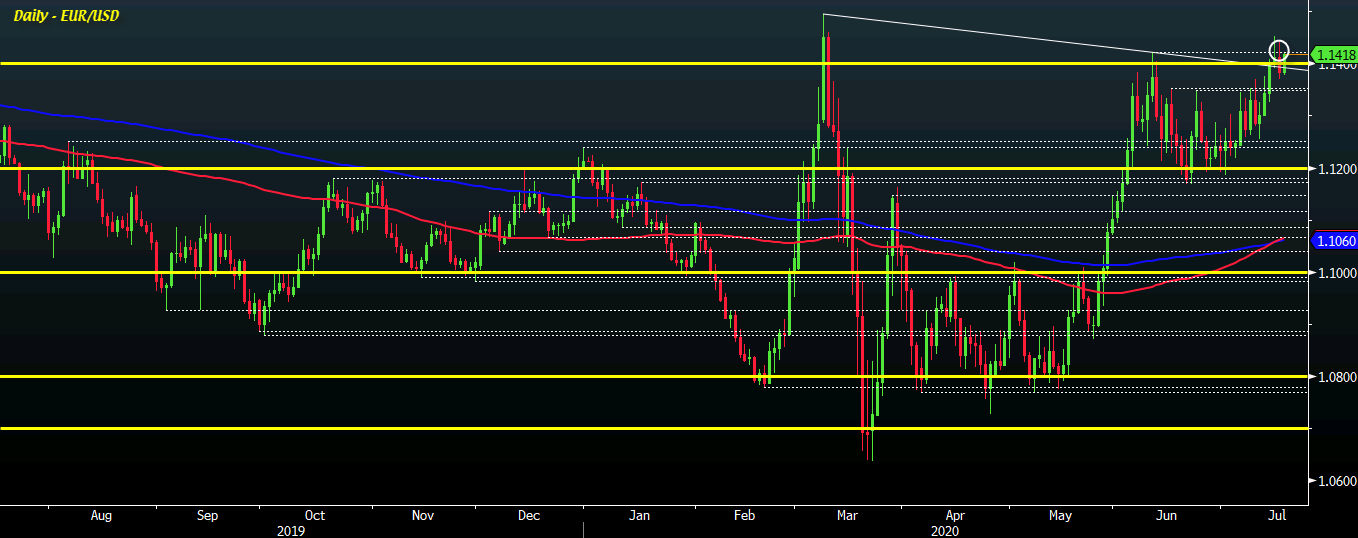

EUR/USD trades to session highs of 1.1420

The euro is looking a little perky as the negotiations on the EU recovery fund begins today, with buyers keeping a more bullish near-term bias on a hold above 1.1400 as well as the 100-hour moving average at 1.1387.

Price action consolidated around the key near-term level since overnight trading but is now inching higher again towards 1.1420.

That said, daily resistance around 1.1422 from the June high remains a key level to watch ahead of the close – not to mention the rather wide swing region from the March highs from 1.1450 all the way through to 1.1495.

All eyes now are on Brussels and whether or not EU leaders can reach a compromise on the recovery fund proposal.

There has been a lot of posturing ahead of talks with Dutch PM Rutte saying that chances of a deal are less than 50%, while German chancellor Merkel also kept a more cautious approach and said that talks are going to be “very tough”.

That said, the bar for a compromise and for good news to flow is relatively low considering expectations. As such, a bit of a positive surprise may give euro buyers enough of a nudge to start looking at 1.1500 next.

But if we do see a breakdown in communication, the risk levels to watch will be the 100-hour moving average @ 1.1387 before we get to the swing region around 1.1345-50.

The 200-hour moving average is also seen @ 1.1345 so a break under there will allow sellers to seize back near-term control should talks go south this weekend and weigh on the euro.

breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)